This is CNBC’s Morning Squawk newsletter. Subscribe here to receive future editions in your inbox.

Happy Thursday. With each passing day of the World Economic Forum, I become more and more envious of those who spend a week in Switzerland.

Stock futures are rising this morning. The three major averages are coming off a strong session.

Here are five important things investors need to know to start their trading day.

1.Swiss watch

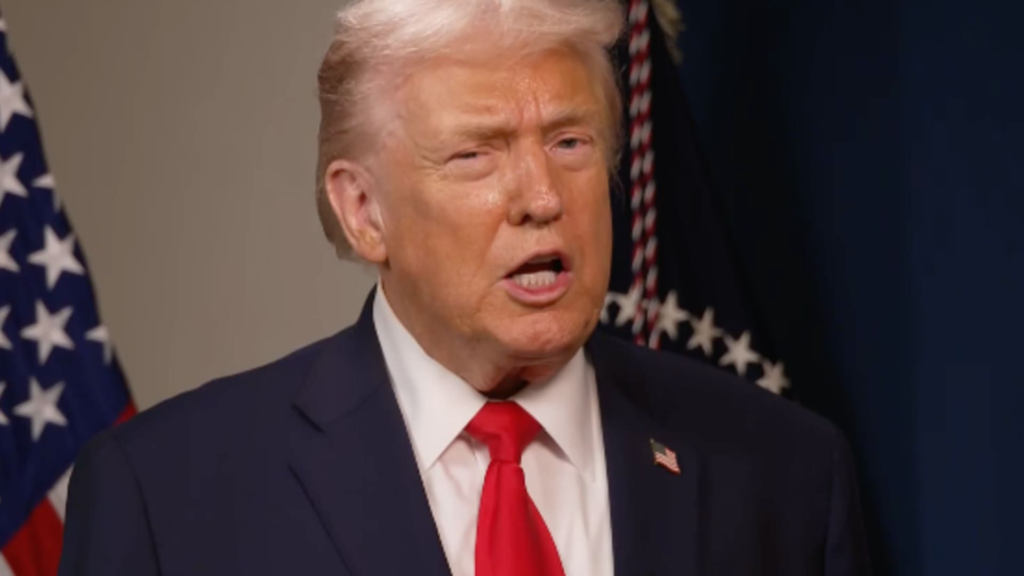

President Donald Trump speaks with CNBC’s Joe Kernen at the World Economic Forum in Davos, Switzerland, January 21, 2026.

CNBC

Stocks rebounded yesterday after President Donald Trump said the United States would not use military force to capture Greenland. Subsequently, the president announced that he had agreed a framework with NATO regarding Danish territory, and the stock price rose further.

Here’s an overview:

2. Not yet cooked

On January 21, 2026, in Washington, D.C., a Supreme Court justice considers President Donald Trump’s move to remove him from office, as Federal Reserve President Lisa Cook, accompanied by her lawyer Abby Lowell, looks on outside the Federal Reserve Board of Governors.

Nathan Howard | Reuters

The Supreme Court yesterday expressed skepticism about the Trump administration’s argument that the president could fire Fed Director Lisa Cook, suggesting Cook’s job may be safe.

Justice Brett Kavanaugh told Trump’s team that the president’s ability to fire Fed directors without judicial review “undermines, if not shatters, the independence of the Fed.” Justice Samuel Alito, another conservative speaker on the court, said it appeared Trump’s firing of Cook was done “very roughly.”

Speaking of the Fed: President Trump told CNBC yesterday that the candidates for the next central bank chairman are “probably narrowed down to one person.” Trump declined to name a favorite.

3. Card declined

JPMorgan Chase CEO Jamie Dimon speaks at the U.S. Chamber of Commerce in Washington on January 15, 2026.

Luke Johnson | Bloomberg | Getty Images

President Trump yesterday asked Congress to incorporate his plan to temporarily cap credit card interest rates at 10% into legislation. but JP Morgan Chase CEO Jamie Dimon was unabashed about the proposal in Davos, saying: “It would be an economic disaster.”

Dimon suggested Trump test the idea in Vermont and Massachusetts. Although Dimon did not name names, these happen to be the home states of Sens. Bernie Sanders and Elizabeth Warren, both of whom support a five-year 10% cap on credit card interest rates.

While in Davos, Mr. Dimon also took an unusual turn to criticize President Trump’s immigration reform efforts. “I don’t like what I’m seeing,” the bank president said, adding that he would like to know more about who was taken in the Immigration and Customs Enforcement raid.

4. Down E

Girete products are displayed on the shelves of a supermarket in Sarajevo, Bosnia and Herzegovina, on October 29, 2024.

Dado Luvić | Reuters

procter and gamble This morning’s second-quarter results slightly beat Wall Street’s profit expectations, but revenue was slightly below analysts’ consensus estimates. Shares fell 1.5% in pre-market trading.

The company, the parent company of Gillette and Downey, said net income was down from the same period last year, but net sales were up 1%. The Ohio-based company lowered its outlook for fiscal 2026, citing increased restructuring costs.

On the revenue side, we’ll be keeping an eye on future reports. intel and alaska airlines Deadline is after the bell today.

5. Cleaning

Nicholas Cocobris | Null Photo | Getty Images

YouTube has aspirations for 2026. It’s about reducing “AI slop.” googleA video platform owned by.

In his annual letter published yesterday, YouTube CEO Neil Mohan said moderating artificial intelligence-generated content and detecting deepfakes are priorities for the platform this year. “It is becoming increasingly difficult to tell what is real and what is generated by AI,” Mohan wrote.

As CNBC’s Jennifer Elias reports, these comments come as Google continues to invest heavily in its AI infrastructure as it builds on its Gemini model and adds AI capabilities to its products.

daily dividend

intel Shares soared more than 11% yesterday to their highest level since early 2022 as investors geared up for the chipmaker’s earnings report scheduled for this afternoon. The situation on the day of stock trading is as follows.

CNBC’s Kevin Breuninger, Spriha Srivastava, Spencer Kimball, Garrett Downs, Sean Conlon, Dan Mangan, Jeff Cox, Hugh Son, Amelia Lucas, Jennifer Elias and Kif Leswing contributed to this report. Josephine Rozzelle edited this version.