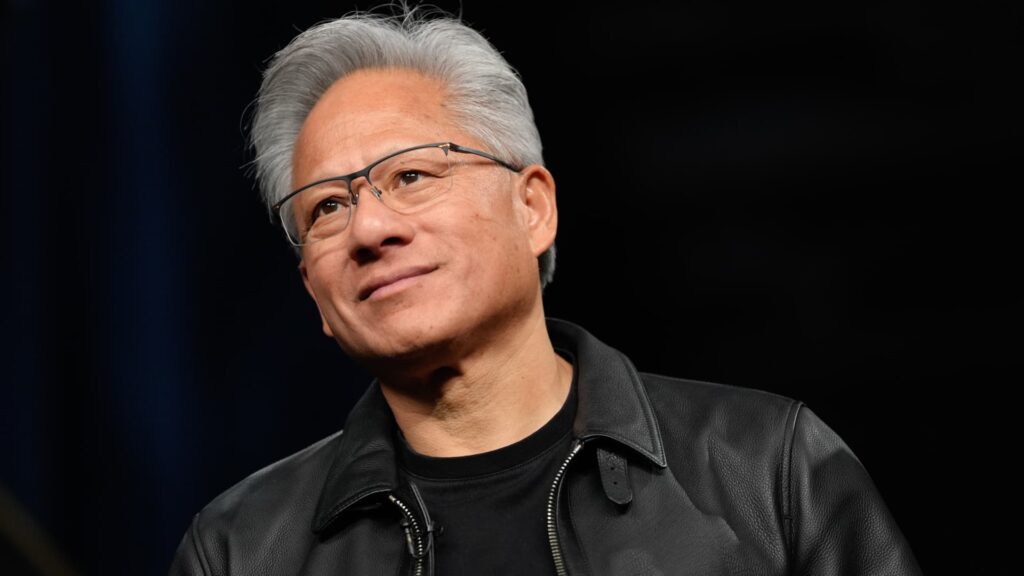

Nvidia Corp. Chief Executive Officer Jensen Huang speaks to Bloomberg TV at the Nvidia AI Summit on Tuesday, October 28, 2025 in Washington, DC, USA.

Kent Nishimura | Bloomberg | Getty Images

This is CNBC’s Morning Squawk newsletter. Subscribe here to receive future editions in your inbox.

Here are five important things investors need to know to start their trading day.

1. Pass the fist

Nvidia It turned heads yesterday, both literally and figuratively. In addition to signing deals with several well-known companies, CEO Jensen Huang also made important announcements regarding domestic production at Chip Titan’s technology conference.

Here’s the full overview:

nokia Nvidia said it would acquire a $1 billion stake in the company. Following the announcement, the Finnish networking company’s U.S.-listed shares rose more than 22%, its best day since 2021.Eli Lilly and Nvidia announced a partnership to build a supercomputer and artificial intelligence factory for the pharmaceutical industry aimed at speeding drug discovery and development. EV manufacturer clear Huang said the company is leveraging Nvidia’s technology with the aim of becoming the first automaker to offer advanced self-driving features, so-called “mind-off” driving, within the next few years. Speaking at the company’s GTC conference in Washington, D.C., Huang said Nvidia’s fastest AI chips are currently being manufactured in Arizona. Blackwell’s GPUs were previously manufactured in Taiwan. Yesterday, Nvidia stock rose 5%, pushing U.S. stocks to another one-day all-time high. The gains make the chipmaker, the world’s largest company by market capitalization, more likely to become the first company to reach a $5 trillion valuation. Follow live market updates here.

2. Decision date

Jerome Powell, Chairman of the Board of Governors of the Federal Reserve System, attends the Fall Meetings of the International Monetary Fund (IMF) and World Bank at IMF Headquarters in Washington, DC, USA, on Thursday, October 16, 2025.

Kent Nishimura | Bloomberg | Getty Images

The Fed is scheduled to announce its penultimate rate decision for 2025 at 2pm ET today, and traders see a rate cut as a foregone conclusion. According to CME’s FedWatch tool, federal funds futures have a 99.9% probability of a 25 basis point rate cut.

Still, investors will be watching to see whether any Fed officials break the majority and whether Fed Chairman Powell’s post-announcement press conference provides any clues about the future direction of monetary policy. Respondents to CNBC’s October Fed survey also expressed concerns about how the central bank is analyzing the economy while some data is withheld due to the government shutdown.

3. What’s in the name?

Sam Altman, CEO of OpenAI Inc., during a media tour of the Stargate AI data center in Abilene, Texas, USA, on Tuesday, September 23, 2025.

Kyle Grillot | Bloomberg | Getty Images

OpenAI yesterday officially completed its reorganization into a nonprofit organization. The startup’s nonprofit, now named the OpenAI Foundation, has a controlling interest worth about $130 billion in OpenAI’s commercial venture, called OpenAI Group PBC. (PBC is an abbreviation for public interest corporation.)

This buzzy AI startup also confirmed its long-time backer microsoft has invested $135 billion in the commercial sector. As CNBC’s Ashley Caputo points out, that’s about 27% of the company’s value on a diluted basis.

Microsoft, along with big tech companies, is scheduled to report earnings after the bell today. alphabet and Meta.

4. 1 month later

On October 27, 2025, the U.S. Capitol Building in Washington, D.C., weeks after the U.S. government shutdown.

Kylie Cooper | Reuters

The federal government shutdown is officially a month old, and Washington is feeling the heat.

Yesterday, a group of more than 20 states sued President Donald Trump’s administration to preserve benefits associated with the Supplemental Nutrition Assistance Program (also known as SNAP), which provides food stamps. The Department of Agriculture, which administers SNAP, announced that benefits will end at the end of this week.

A federal judge yesterday also extended a temporary ban on firing federal employees during the government shutdown. Meanwhile, air traffic controllers union officials said that some members have started side jobs to earn money while working without pay.

5. Flight status

A Boeing 777X sign at the Boeing Co. booth at the Aircraft Interiors Expo (AIX) on Tuesday, April 8, 2025 in Hamburg, Germany.

Bloomberg | Bloomberg | Getty Images

shares of boeing Shares fell slightly in premarket trading this morning after the aircraft maker reported third-quarter earnings. The airline returned to cash surplus territory for the first time since 2023, but recorded a $4.9 billion charge related to delays to its 777X aircraft.

Boeing, which has been plagued by manufacturing and supply chain issues as well as the aftermath of two crashes, is on track to make the most deliveries since 2018. Chief Executive Officer Kelly Ortberg, who took the helm at Boeing in 2024, said in a staff note that while there was “more work to do to move our development programs forward,” there were “positive signs across the business.”

daily dividend

—CNBC’s Kiff Lesswing, Annika Kim Constantino, Mike Weiland, Sean Conlon, Ashley Caputo, Jeff Cox, Kevin Browninger, Dan Mangan and Leslie Josephs contributed to this report. Josephine Rozzelle edited this version.