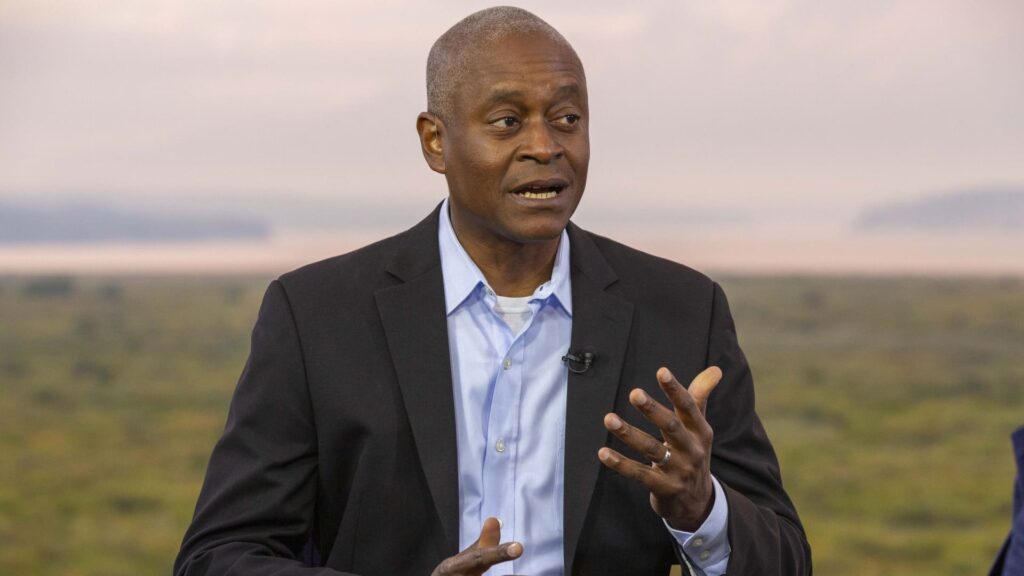

Atlanta Fed President Rafael Bostic announced Wednesday that he will step down when his term ends in February.

Mr. Bostic has held his current position since June 2017 and is the first black and openly gay regional president. His term ends on February 28, with issues related to personal investments also being prominent.

“I’m proud of what we accomplished during my term in making the noble goal of an economy that works for everyone more of a reality, and I look forward to discovering new ways to advance that bold vision in the next chapter,” Bostic said in a statement.

The announcement comes ahead of a big year for the Fed and its rate-setting agency, the Federal Open Market Committee.

Regional president terms are five years, typically run synchronously, and are designed to expire in years ending in either 1 or 6, and so on next year. Regional boards will vote on the president, but approval from the Fed’s board is required. Normally a routine process, unusual political dynamics on the board can add new wrinkles to the process.

In addition to the reappointment of regional governors, Federal Reserve Chairman Jerome Powell’s term expires in May, but his term as Fed president will continue until 2028.

Mr. Bostic has been seen as more of a centrist during his time in office, but he has been more cautious about cutting interest rates this year amid expectations of higher inflation and a weaker labor market. He is not a FOMC voter this year. The next vote in Atlanta will be in 2027.

Powell said Bostic’s “perspectives have deepened the Federal Open Market Committee’s understanding of our nation’s dynamic economy, and his steady voice embodies the best public service that is analytical, empirically grounded, and purposeful.”

Cheryl Venable, first vice president and chief operating officer of the Atlanta Fed, will assume the role of president until the Board of Directors names a successor.

Mr. Bostic’s tenure was not without controversy.

In October 2022, the Fed announced it was looking at trades Bostic made during a blackout near a policy meeting. At the time, 154 transactions were made on his behalf, according to an internal report. However, the report also noted that there was no evidence that Bostic traded using insider information or that there was any personal conflict.

Other issues were raised regarding financial disclosure conditions and inappropriate levels of Treasury holdings.

For his part, Bostic expressed regret about the discrepancy and said the transactions were executed by a third-party manager over which he had no control.

The controversy is part of a larger issue over investments by Fed officials, which has led to tightening of internal controls and rules about what types of securities Fed officials can hold.