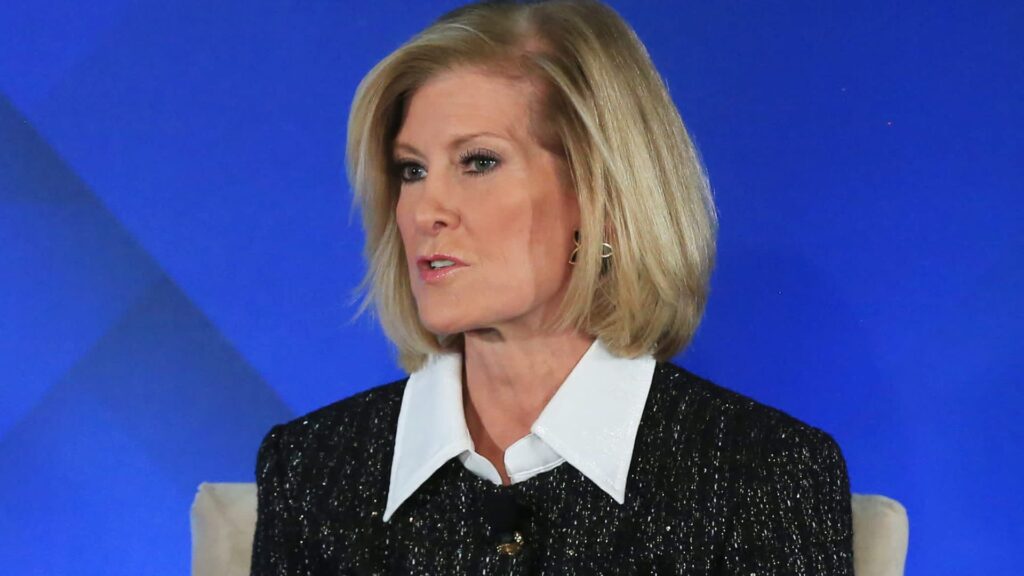

JPMorgan Asset & Wealth Management CEO Mary Callahan Eldees speaks at CNBC’s “Delivering Alpha” event in New York City on November 13, 2025.

Adam Jeffrey | CNBC

NEW YORK — Mary Callahan Erdoes, CEO of JPMorgan Asset & Wealth Management, says investors should focus less on whether there is a bubble now and more on the future opportunities presented by artificial intelligence.

Speaking at the CNBC Delivering Alpha conference on Thursday, Erdos dismissed concerns about valuation, saying AI presents opportunities that are not yet fully appreciated or understood.

“I feel like we’re on the brink of a lot of things right now,” she said during a panel discussion. “So we’re in this disconnect in the world where we’re pricing AI where to put it, where to put it in multiple places. Companies don’t understand it until they actually use it. But it’s very similar to what Hemingway said, ‘How do we go bankrupt?'” It happens very slowly and suddenly, but I think that’s exactly what’s going to happen with AI. ”

Concerns over soaring valuations of companies such as NvidiaAMD and many other companies involved in AI trading have caused repeated fluctuations in the market, yet the market is still hovering near all-time highs.

Stocks sold off Thursday, marking their worst day in more than a month as concerns resurfaced.

Michael Arrogetti, CEO and director of Ares Management Corporation, speaks at CNBC’s “Delivering Alpha” event in New York City on November 13, 2025.

Adam Jeffrey | CNBC

“AI itself is not a bubble. It’s a crazy concept. … We’re on the precipice of a big, big revolution in how companies operate,” Erdos said. “If you ask yourself, is AI in a bubble? I think you have to be very specific about how you answer that, because AI is starting to gain momentum in the U.S., but we’re a long way from the ability to get everything to the finish line.”

“You’re going to see explosive growth on both the revenue and expense side, so that supplier will need to understand how it moves through the pipeline,” she added.

Herdees wasn’t alone in her assessment.

Michael Arougheti, CEO of Ares Management, said the current level of investment is small compared to the potential that AI holds.

“We still have a long way to go in terms of economic investment relative to the size of our economy,” Arrogeti said. “We can’t get supply fast enough to meet short-term demand. So I feel like there’s a lot of exaggeration because the numbers are big and so revolutionary.”

On macro issues, both said they do not believe a recession is imminent.

“People have been crying for a recession for five years, but it’s not here yet,” Arrogeti said.

“If there’s no recession on the horizon, it’s a great buying opportunity and you should lean in and buy,” Eldees added of credit investing.