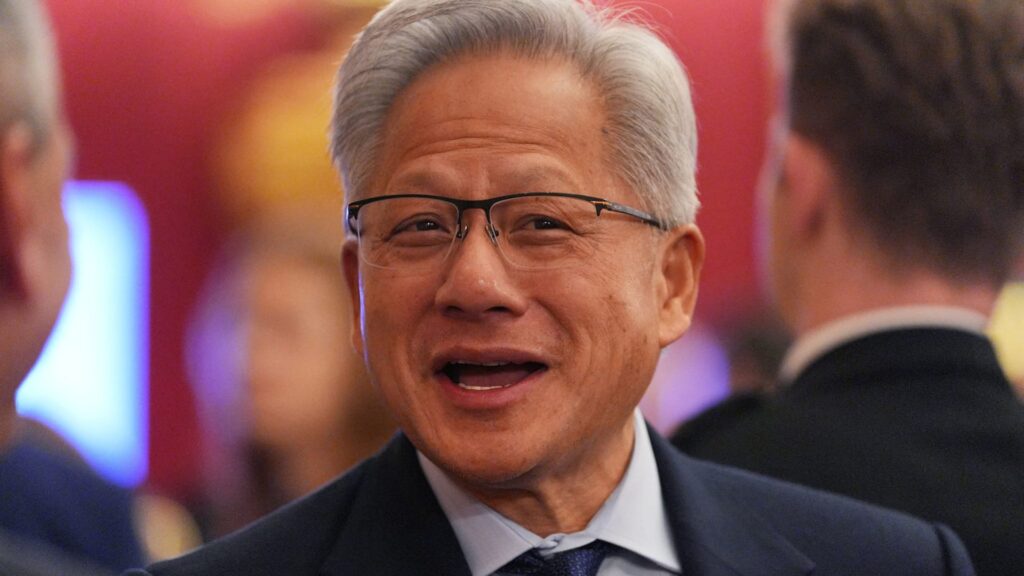

Jensen Huang attends the 2025 Queen Elizabeth Engineering Awards Reception held at St. James’s Palace on November 5, 2025 in Briline, London.

Mok Yui | via Reuters

Nvidia CEO Jensen Huang said in October that the company’s orders for chips, which are at the heart of the artificial intelligence boom, are expected to reach $500 billion in 2025 and 2026.

For a company that has seen quarterly revenue growth of nearly 600% over the past four years, Huang’s comments signaled confidence that NVIDIA will continue to see strong growth this year in the next chip cycle, but that growth has slowed, suggesting there is still room for the AI boom to continue.

“That’s the amount of business we have on the books. It’s worth $5 trillion so far,” Huang said at the company’s GTC conference in Washington.

Huang includes revenue so far in 2025, sales of Nvidia’s current Blackwell graphics processing units and next year’s Rubin GPUs, as well as related components such as networking. Analysts analyzed the details of Mr. Hwang’s comments and concluded that the comments suggested that sales in 2026 would be much higher than Wall Street had previously expected.

“NVDA’s disclosures signal clear upside to current consensus estimates,” Wolfe Research analyst Chris Caso wrote in a November note. Caso estimated that Huang’s data points suggest data center revenue could exceed previous calendar forecasts in 2026 by $60 billion. He has a “buy” rating on the stock.

However, NVIDIA’s stock price is trading 5% below where it was when Huang called for investment in the company on October 28th.

This reflects an ongoing debate among investors about the AI boom and whether a small number of large cloud companies, known as hyperscalers and AI labs, are overspending on infrastructure.

When Nvidia reports its third-quarter results on Wednesday, analysts surveyed by LSEG expect the company to report earnings of $1.25 per share on revenue of $54.9 billion, an increase of 56% from a year ago. They also want guidance for the January quarter of $61.44 billion, indicating a reacceleration of growth.

Nvidia doesn’t provide more than a quarter forward outlook on revenue. But anything Mr. Huang says about the company’s sales balance and calendar 2026 outlook will likely be scrutinized not just for Nvidia’s outlook, but for the broader technology industry as well. Analysts surveyed by LSEG currently expect NVIDIA’s revenue to be $286.7 billion in 2026.

“AI’s insatiable desire”

At the Washington conference, Huang said the company has “visibility” to its revenue. That’s not surprising. NVIDIA counts nearly every multi-trillion dollar technology company among its customers. google, Amazon, microsoft and meta.

In their October results, all of these companies announced increased capital spending on artificial intelligence infrastructure, namely Nvidia chips.

Oppenheimer analyst Rick Schaefer wrote in a note earlier this month that hyperscalers’ increased capital spending reflects an “insatiable appetite for AI.” He rates Nvidia stock a “buy.”

Nvidia was also an active deal maker this quarter, and analysts will want to hear more details about these partnerships from Huang.

The biggest deal was NVIDIA agreeing to invest up to $10 billion in OpenAI stock in exchange for the AI startup buying 4 million to 5 million GPUs over several years. Nvidia also agrees to invest $5 billion in former rival intel. The deal will see the two chipmakers team up to help Intel chips work better with Nvidia GPUs.

After the October quarter ended, Nvidia acquired a $1 billion stake in Nokia and entered into a partnership to integrate the company’s GPUs into the Finnish company’s cellular network hardware. Nvidia also continued to invest in various startups.

Citi analyst Atif Malik said in a November note that the deal with OpenAI in particular will attract investor attention on Wednesday.

“While there are concerns about the combination of debt and cyclical financing surrounding the AI capital investment bubble, we fundamentally see AI supply below demand,” Malik wrote. He has a “buy” rating on the stock.

Nvidia has over 90% of the AI GPU market. But its customers also include Amazon with its Tranium chips, Google with its TPU chips, and OpenAI with upcoming chips developed in partnership. broadcom — has ramped up its promotion of custom semiconductors, application-specific integrated circuits, or ASICs, over the past three months.

Citi said Huang often speaks generally about Nvidia’s views during earnings calls with analysts and may elaborate on how the company views the increased competition welcomed by investors.

All of these forecasts exclude sales in China. Exports of the company’s China-bound chips, called H20, were effectively restricted earlier this year, but in August Huang struck a deal with President Donald Trump to obtain export licenses in exchange for the government receiving 15% of sales in China.

But since then, Nvidia representatives have made gloomy comments about the potential for significant sales to China, and the company has not announced a successor to the H20, which is outdated by AI chip standards. Schaefer, the Oppenheimer analyst, said he believes there is an annual revenue opportunity of more than $50 billion in China.

Asked by CNBC in late October if he wanted to sell the current Blackwell generation of chips to China, Huang said, “I hope so. But that’s for President Trump to decide.”

Attention: Markets are still behaving rationally, so we are unlikely to be in an AI bubble: JPM AM