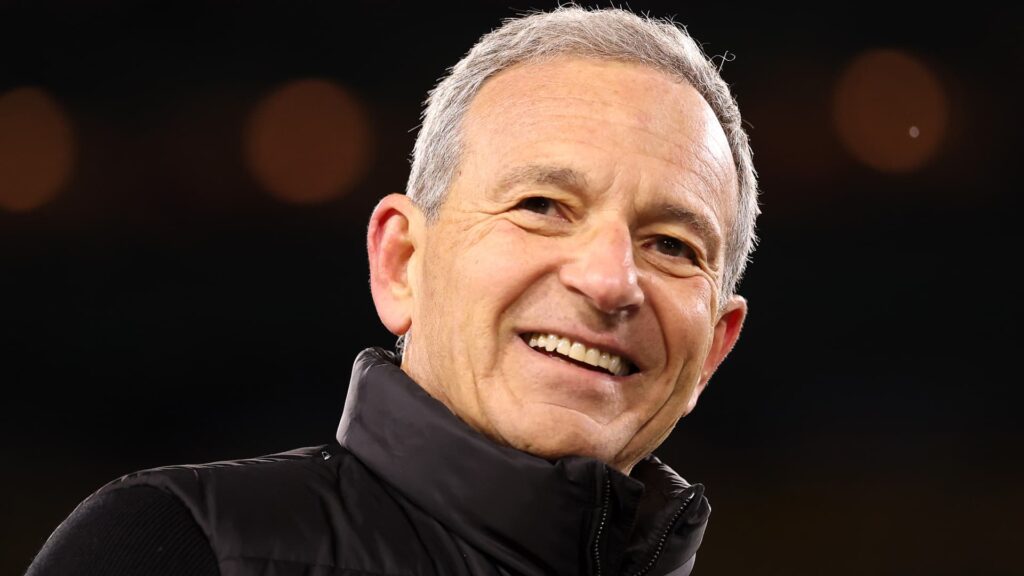

Walt Disney Company CEO Bob Iger watches the Philadelphia Eagles vs. Green Bay Packers game at Lambeau Field on November 10, 2025 in Green Bay, Wisconsin.

Michael Reeves | Getty Images Sports | Getty Images

Disney shares edged higher in premarket trading Tuesday morning as investors focused on who will succeed CEO Bob Iger.

As of 7:05 a.m. ET, the media giant’s stock was up 0.14%. The company fell 7% on Monday after announcing before the bell that its experiential division, which includes theme parks, resorts and cruises, had quarterly sales of more than $10 billion.

The company’s total revenue was about $26 billion, up 5% annually, beating Wall Street’s $25.7 billion estimate.

CEO change causes an “overhang” in stock prices

Disney’s board of directors is scheduled to meet this week to vote on the company’s next CEO, said the people, who asked not to be identified discussing internal matters.

This is the second time the company has appointed a successor to Mr. Iger. His first term as CEO ended in 2020. Disney named Bob Chapek to the top position. But Chapek was fired at the end of 2022, prompting Iger to return.

“The impending management change remains impacting the stock price, but a resolution is reportedly imminent,” Jefferies analysts said in a note Monday.

BofA analysts also said in a note Monday that succession issues have “recently weighed on stock prices.”

“We made a mistake in trying to maintain the status quo” in appointing Capek, Mr. Iger said during Monday’s earnings call, adding that “there were a tremendous number of things that needed to be fixed” when he returned to the role.

He added that he thinks his successor will be “a good resource in terms of the strength of the company, the many opportunities to grow, and the expectation that we must continue to change and evolve as well in a changing world.”

Disney Experience Chairman Josh D’Amaro is one of the top candidates to replace Iger, industry and Disney officials previously told CNBC. Dana Walden, co-chairman of Disney’s entertainment division, is another name in contention.

BofA analysts said D’Amaro’s appointment will be “welcomed by the investment community” given the value of the Experience division to the company’s revenues.