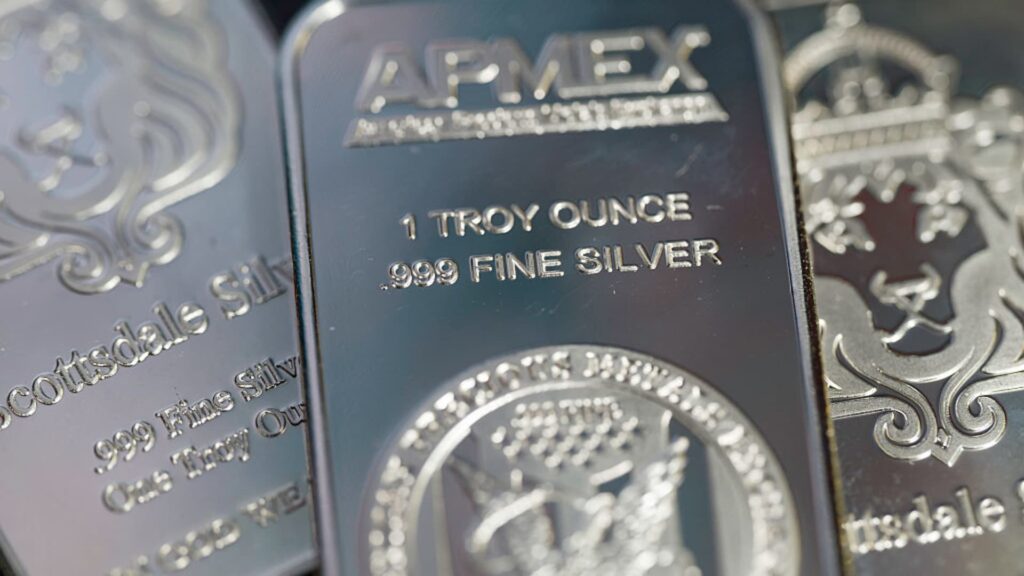

Silver bars are shown in a photo illustration as the price of silver fluctuates amid changing industrial demand and global market volatility in Brussels, Belgium, December 24, 2025.

Jonathan Ra | Null Photo | Getty Images

With little geopolitical news in a holiday-shortened week, silver and gold fell in pre-market trading on Tuesday as investors awaited lagging economic data.

spot silver It was last seen trading around $74.85 an ounce, down 2%. silver futures It fell 4% to trade at $74.7 an ounce.

hecla mineThe company, which owns Alaska’s Green Creek mine, one of the world’s largest silver mines, fell 3% before the market opened. Meanwhile, Endeavor Silver fell 3.5% and First Majestic Silver fell nearly 4%. cool mining Although it fell by nearly 3.4%, tech resources Silvercorp Metals fell about 3% and Wheaton Precious Metals fell more than 2%.

Despite renewed geopolitical tensions in the Middle East, Deutsche Bank analysts said in a note Tuesday that silver “is trading $7 below its 1790 real-adjusted price” after falling in price in the morning.

meanwhile, spot gold It fell more than 1% to $4,931 an ounce. gold futures It fell nearly 2% to trade at $4,952 an ounce.

Silver ETFs including ProShares Ultra Silver fell 7% premarket, while iShares Silver Trust and ABRDN physical silver fell more than 3%, according to FactSet data.

silver price.

Gold and silver prices fell in late January as investors reacted to the news that President Donald Trump had nominated Kevin Warsh to lead the Federal Reserve, leading to a stronger dollar. Silver futures fell 30% at one point, the worst day since March 1980.

However, the decline in precious metals did not last long, with gold and silver rebounding in early February.

Elsewhere, Australia’s global mining company BHP Signed a silver deal with Wheaton Precious Metals. The mining giant said the long-term silver streaming agreement would see BHP receive a $4.3 billion upfront payment in exchange for delivering silver produced at its Antemina mine.