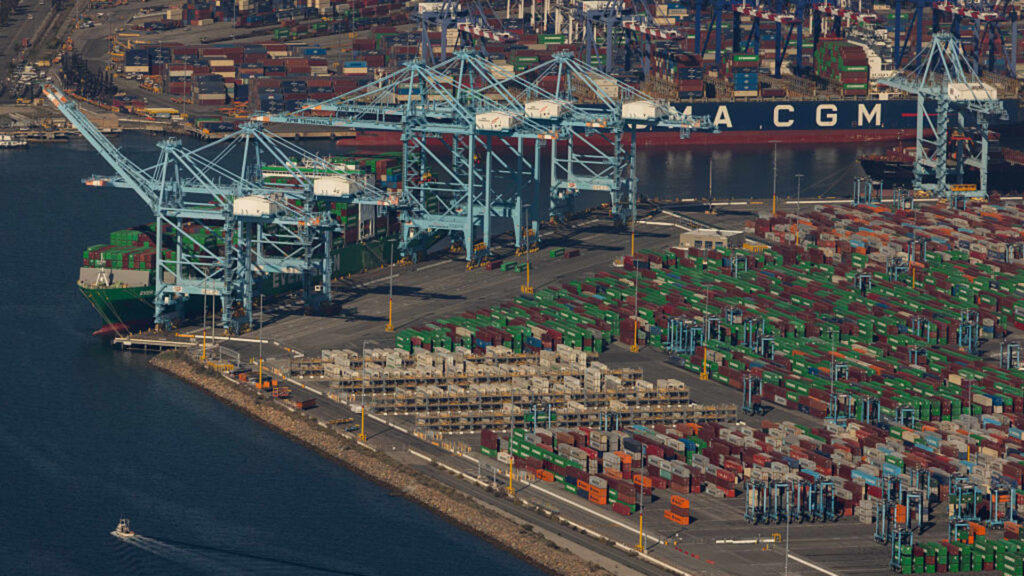

The Port of Los Angeles seen from the Goodyear Airship on Thursday, December 11, 2025 in Los Angeles, California.

Juliana Yamada | Los Angeles Times | Getty Images

New data from the Port of Los Angeles shows that China’s promise to increase its purchases of U.S. agricultural products as part of a trade deal between Chinese President Xi Jinping and President Donald Trump has yet to materialize, contributing to cargo volumes at the nation’s busiest port falling to near a three-year low.

The total volume of processed cargo at the Port of Los Angeles in January was down about 12% from a year earlier, and Port of Los Angeles Executive Director Gene Seroka cited a decline in agricultural exports as the main factor. “Exports to China are in a dire situation,” he said.

Exports to China are down significantly across the country’s major ports, with container exports down 26% last year, according to data shared by the Port of Los Angeles. Seroka said Los Angeles was hit hard by soybeans, a key agricultural export.

In early 2026, President Trump announced that China was considering purchasing an additional 8 million tons (20 million total) of U.S. soybeans for this season, following an agreement to purchase 12 million tons in October 2025.

Soybean shipments from the Port of Los Angeles to China fell 80% last year, with no improvement seen in November or December after initial talks between the U.S. and China.

“This is a very important part of our overall export strategy,” Seroka said. “Argentina and Brazil are winning a lot of the soybean contracts going to China,” he said, adding that it will take time for the U.S. agricultural sector to increase its export capacity. “These are not transaction-type applications. These are agreements over the last three, six, 12 months. So it will take another cycle for U.S. soybean exporters to have a chance to bid and be in the game,” he added.

The Port of Los Angeles reported approximately 812,000 20-foot equivalent units (TEUs) in January, including imports, exports, and empty containers. Approximately 924,000 TEU were reported in January 2025, with freight forwarding accelerating ahead of the start of President Trump’s second phase of tariffs, as well as the key holiday period in Asia. Looking at the breakdown of the number of containers, imports in January amounted to 421,000 container units, down almost 13% from last year’s high level. On the export side, 104,000 containers were processed, down nearly 8% year-on-year.

Empty export containers sent back to Asia during periods of high demand, a forward-looking indicator of demand in Asia, totaled 286,000 TEU, down 12.5% from last year, according to the Port of Los Angeles.

Seroka said the increase in 2025 numbers compared to a period when importers were scrambling to source cargo ahead of tariffs will continue to be a factor in comparisons through much of 2026. “U.S. trade policy remains largely uncertain, and we expect that to continue.”

The drop in cargo container imports at China’s largest port comes during a typically busy period for import activity from manufacturing hubs in China and broader Asia for the Lunar New Year, as companies bring in spring and summer goods before Chinese manufacturing plants close for a month to celebrate the Lunar New Year. Seroka said the slowdown in demand for goods was also visible in previous February data, with container arrivals appearing to be “flat”. “Compared to the significant drop in the first quarter of last year, we expect a drop of less than 10% in the first quarter, and we don’t think the economy or cargo volumes will fall off a cliff after that,” he said.

But he added that January’s numbers were worrying. “This is our lowest monthly production in nearly three years,” Seroka said. “This confirms why trade policy is so important. American farmers and manufacturers need to remain competitive in global markets. We can’t afford to lose any more ground,” he said.

Maritime shipping economics on U.S. routes near “break-even point”

With U.S. port activity down, freight rates are trending lower and ships have too much available container capacity, putting pressure on the overall ocean shipping market.

Peter Sand, chief shipping analyst at Xeneta, said the decline in container volumes was causing a widespread decline in ocean freight rates. In the “low-mid market segment” (generally dominated by large shippers), rates fell more than 18% last month, compared to a market average decline of 11.5%.

“Shippers paying market average should expect further rate softening in the coming weeks, with the mid-to-low market acting as a bellwether and expected to be immediately impacted by increased trans-Pacific capacity,” Sand said.

Ocean carriers will respond with what Sandoz calls “active capacity management.” This means increasing the number of canceled flights to fill the lower bound of interest rate declines.

In a recent note to customers, Honor Lane Shipping said current freight levels are “near or below” the carrier’s break-even point on all lanes bound for the U.S. and Canada.

HLS noted that the number of sailing cancellations from the week of February 9 reflects a 60%, 58%, and 50% decrease in shipping capacity in the Asia-Pacific Southwest, Asia-Pacific Northwest, and Asia-US East Coast trade lanes.

As a result of flight cancellations, containers may be “rolled” once or twice while they remain in Asia. That means containers sit idle on the trade calendar for weeks before being loaded onto ships destined for the United States. “This could result in supply chain disruptions and delays for shippers,” Sand said.

According to trade statistics compiled by Descartes, China’s import structure in January remained highly concentrated in consumer goods and industrial products, with furniture and bedding totaling 126,149 TEU, accounting for 16.4% of China-origin imports. Plastics accounted for 15.4%, and the combined machinery and electrical machinery import category amounted to 18.3% of the total volume. Apparel, footwear and other textile products together accounted for 6.5% of the total volume, while toys and sporting goods accounted for 5.8% of imports, according to Descartes data.

The decline in trade volumes from China has been offset to some extent by the expansion of manufacturing to Southeast Asian countries. Descartes said U.S. container imports from Vietnam rose 17.8% year-on-year in January, while imports from Thailand and Indonesia rose 36.5% and 18%, respectively.

“Expanding sourcing from Southeast Asia continues to offset some of the decline in China-origin imports,” Honor Lane wrote in a recent note to clients.

Seroka said that at the start of the first trade war in 2018, about 60% of the Port of Los Angeles’ import business was tied to China, but “now it’s 40% and that’s down.” This port has been able to grow through the combination of Southeast Asian countries such as Vietnam, Malaysia, Cambodia, Indonesia, and the Philippines. “But again, we are not going to replace China or some provinces of China with another origin,” Seroka said.

Los Angeles’ sister port, the Port of Long Beach, reported record container volumes as a result of front-loading in 2025, boosted by trade from Southeast Asia.