According to a White House post about X, more than 1 million people have signed up for Trump accounts as a result of the massive promotional campaign. Well before the opening date in July.

Perhaps “free money” will be a great incentive. The federal government announced it will make a one-time contribution of $1,000 to the accounts of all eligible children born on or after January 1, 2025, by December 31, 2028. A growing number of companies are pledging to match Treasury deposits for the children of their employees, and philanthropists in several states have pledged to donate to the accounts of specific eligible families.

“The president called on business leaders and philanthropists across the country to join us in this effort,” Treasury Secretary Scott Bessent said Friday in a speech at the Dallas Economic Club.

But beyond the initial deposit, many questions remain about how these accounts are managed and invested.

“There are more unanswered questions than there are answers at this point,” said Mary Morris, CEO of Commonwealth Savers, the agency that manages the national Invest529 program. A 529 college savings plan is another tax-advantaged investment option that allows families to save on behalf of their children.

“There’s a lot of good stuff out there, but there’s still a lot of unknowns about how it works,” Morris said.

How is my account verified?

First, it’s not entirely clear how Trump’s account application will be verified.

To set up a Trump Account (also known as a 530A account), a parent or guardian must file IRS Form 4547 with their 2025 tax return or via TrumpAccounts.gov. Next is the “certification process,” which is expected to begin sometime in May. There are no details yet on what that means, but the White House says the federal seed money is expected to arrive on July 4.

How will the funds be invested?

Trump account viewed on mobile phone.

Provided by Trump Account

Trump’s account site shows a mockup of an unreleased app interface that tracks returns for some stocks. However, according to Treasury guidelines, Mr. Trump’s account would be invested in “broad-based U.S. stock index funds” such as mutual funds and exchange-traded funds, rather than individual stocks like Nvidia.

“This is a smart way to take advantage of some trending stocks and sell stocks, trying to get more bang for your buck,” said Ben Henry Moreland, senior financial planning geek at advisor platform Kitces.com. Exact investment options have not been announced.

While the “100% stock investment option” has its benefits, a recent Vanguard research paper notes that the Trump account “does not incrementally reduce risk toward a fixed income allocation” like other account types, such as a 529. These typically start with more equity exposure early on and become more conservative over time as the fundraising target date approaches.

How will President Trump’s account affect the stock market?

When the U.S. stock market opens on Monday, July 6, more than 3.5 million accounts will be pre-funded with $1,000 grants for newborns based roughly on the number of babies born in a year, potentially kicking off the post-holiday trading week, according to CDC data.

If all of these accounts were funded with an additional $1,000 in employer matches and $500 in family contributions, there would be as much as $8.75 billion flowing into the market, said Christopher Mistal, director of research at Stock Traders Almanac.

Still, this is only 1.7% of the market’s average daily activity, far less than the large capital inflows resulting from the Federal Reserve’s bond-buying program known as quantitative easing, Mistal told CNBC.

“The percentage will decline further due to fewer participants, fewer funded accounts, or both,” he wrote in a follow-up email. He added that if the program were rolled out over multiple trading sessions, the impact on the market would be further diminished.

“With large numbers of participants and money, Trump’s account could have a modest but hard-to-measure bullish impact during an already historically bullish period,” Mistal said, referring to the typical timing of the mid-year rally in July.

“Even if all of the children’s money were traded in one trade a day, it would still be a relatively small percentage of the total market volume for the day,” Matt Lira, co-founder of Invest America, a nonprofit advocacy group that supports Trump’s accounts, said in an interview on CNBC.

Invest America also paid for Trump Accounts’ Super Bowl commercials to promote its new investment account for children.

Where will the custodian financial institution be?

The Treasury Department says Trump’s account will be held by a “designated financial agent,” whose identity has not yet been made public.

“For now, my main question is answered: Who will be in charge?” Henry Moreland said.

Account managers may need to keep track of the beneficiary basis, the non-taxable portion of the account, and subsequent taxable earnings.

Additionally, Zach Teutsch, founder and managing partner of Values Added Financial in Washington, D.C., previously told CNBC that investors may need to consider storage fees that can reduce returns. Teutsch is a member of CNBC’s Financial Advisory Council.

How will President Trump’s account affect his annual tax return?

Another potential issue is gift tax filing requirements. Parents, guardians, grandparents and others can donate up to $5,000 a year (after taxes) to Mr. Trump’s account, and experts say they may have to file a gift tax return even if their total gift is less than the annual deduction. The annual gift exclusion amount for 2026 is $19,000 per recipient.

To qualify for the annual exclusion, the gift must be of “current interest” and immediately accessible to the recipient. Some financial advisers have questioned whether gifts to Mr. Trump’s accounts meet that standard, potentially triggering gift tax filings.

Invest America’s Lira told CNBC that the Treasury Department is “aware of the issues” surrounding potential gift tax filings. “They are tracking that issue very closely,” he said.

Lira said the Treasury Department “will continue to issue guidance on these issues.”

What are the tax implications on withdrawals?

How distributions, including contributions by parents, qualified charities, and the government, will be taxed in the future is another issue the IRS will need to clarify.

To be sure, investors in Trump accounts need to plan for future taxes on withdrawals, experts say.

“These accounts act like (individual retirement accounts),” said Marianela Corrado, a certified financial planner and CEO of Tobias Financial Advisors in Plantation, Florida. Pre-tax funds are subject to ordinary income taxes upon withdrawal, she said.

Additionally, withdrawing funds before age 59 1/2 could result in a 10% penalty, with some exceptions, said Corrado, a certified public accountant and member of CNBC’s Council of Financial Advisors.

Calculating taxes on future withdrawals would require pre-tax and after-tax records of contributions to the Trump account, he said.

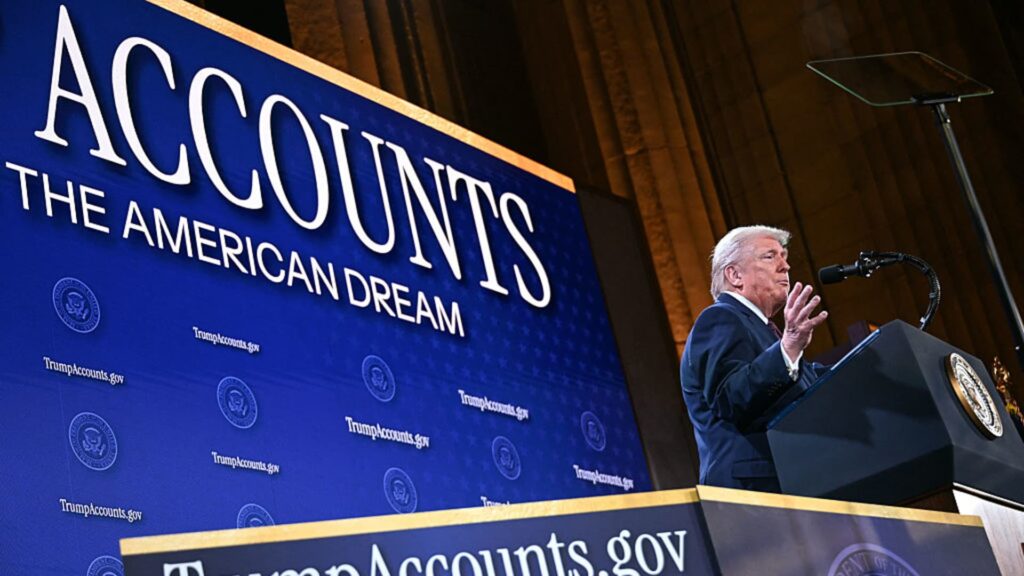

U.S. President Donald Trump speaks about the “Trump Account” at the Andrew W. Mellon Auditorium in Washington, DC, on January 28, 2026.

Brendan Smialowski AFP | Getty Images

Funds in the Trump account grow tax-deferred until withdrawn. There is no upfront tax deduction for after-tax contributions, but earnings are subject to tax upon withdrawal. On the other hand, pre-tax contributions are excluded from your income, but you are liable to pay future taxes on the contributions and any future growth.

The breakdown is as follows:

Direct Parent Contributions — After-Tax Pilot Program $1,000 — Pre-Tax Employer Contributions — Pre-Tax Other Qualified Contributions — Pre-Tax Future Contribution Increases — Pre-Tax

Experts say that if you don’t track your after-tax funds, you could end up paying ordinary income taxes on all future withdrawals from your Trump account.

Invest America’s Lira told CNBC that long-term tracking of the source of funds in the Trump account and future tax treatment is “obviously a concern for financial institutions and something to consider.”

“As a result of our conversations with these financial institutions, we have found that there are solutions for tracking information over the life of an account,” he said.

For now, financial advisers generally recommend that families eligible for “free funds” open a Trump account and wait until all information is available before deciding whether to add additional funds.