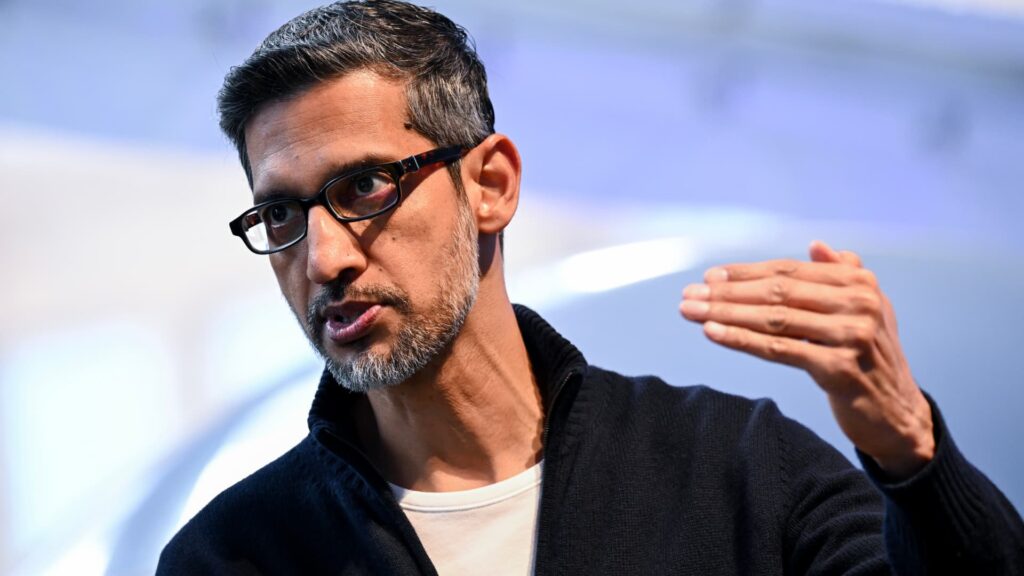

Alphabet Inc. Chief Executive Officer Sundar Pichai during the Bloomberg Tech Conference on Wednesday, June 4, 2025 in San Francisco, California, USA.

David Paul Morris | Bloomberg | Getty Images

Google’s parent company alphabet continues to invest in AI infrastructure to meet customer demand and plans a “significant increase” in spending next year, executives said Wednesday.

The company on Wednesday reported first quarter revenue of $100 billion, beating Wall Street expectations for Alphabet’s third quarter. Executives later said the company plans to increase capital spending this year.

“Due to growth across our business and demand from our cloud customers, we expect our capital expenditures to be in the range of $91 billion to $93 billion in 2025,” the company said in its earnings call.

This is the second time the company has increased capital investment this year. The company raised its forecast in July to $85 billion from $75 billion, most of which will go toward investments in new data centers and other projects.

Executives said Wednesday they expect more spending in 2026.

Anat Ashkenazi, Alphabet’s head of finance, said: “We anticipate a significant increase in capital spending into 2026 and will provide further details in our fourth quarter earnings call.”

The increase comes as companies across the industry race to build out more infrastructure to meet customer demands for billions in computing needed to power AI services. Also on Wednesday, Meta raised the lower end of its 2025 capital spending guidance by $4 billion, saying it expects that number to be between $70 billion and $72 billion. This figure was previously between $66 billion and $72 billion.

Google executives said the company is scrambling to meet demand for its cloud services, which saw its backlog increase 46% from the previous quarter in the third quarter.

“We continue to drive strong growth with new businesses,” CEO Sundar Pichai said. “Google Cloud accelerated, ending the quarter with $155 billion in outstanding balances.”

The company reported a 32% year-over-year increase in cloud revenue, keeping pace with its mega-cap competitors. Pichai and Ashkenazi said the company has received $1 billion more in deals in the past nine months than in the previous two years combined.

In August, Google won a six-year, $10 billion cloud contract from Meta. Anthropic last week announced a deal that gives the company access to up to 1 million of Google’s custom-designed Tensor Processing Units (TPUs). The deal is worth tens of billions of dollars.

Executives said on the conference call that spending on infrastructure is also helping improve the company’s AI products.

Google’s flagship AI app, Gemini, currently has more than 650 million monthly active users. This is up from the 450 million active users Pichai reported last quarter.

Advances in AI have also improved search, executives said. Google’s search business posted revenue of $56.56 billion, up 15% from a year ago, allaying fears that a competitive AI environment could cannibalize the company’s core search and advertising business.

Google’s AI mode, the AI product that powers its search engine, has 75 million daily active users in the U.S., and its search queries doubled in the third quarter, executives said. They also reiterated that the company is testing advertising on its AI mode products.

Attention: Google catches up with Meta, shares fall after earnings, DA Davidson’s Gil Luria says