chip manufacturer Advanced Micro Devices (AMD) Shares fell 9% in premarket trading Wednesday after first-quarter estimates fell short of some analysts’ expectations.

AMD reported fourth-quarter revenue of $10.27 billion, which beat the LSEG consensus estimate of $9.67 billion on Tuesday.

The company said it expects first-quarter sales to be $9.8 billion, plus or minus $300 million, compared to the expected $9.38 billion. But some analysts had expected chipmakers to provide stronger guidance for the first quarter as the boom in spending on processors needed to power AI continues.

Along with AMD, Nvidia is one of the leading manufacturers of AI chips, and its stock price has risen more than 100% over the past year on the back of rising demand.

AMD stock price over the past year

“First of all, expectations were very high,” Susquehanna’s Chris Rowland said on CNBC’s “Closing Bell Overtime.”

“Secondly, the company announced unexpected revenue in China for the quarter. This wasn’t a street number, so taking that into account, it was a much smaller hit than expected.”

But demand for AMD’s chips in data centers remains strong, and the company has hinted at signing multi-gigawatt deals in the future, he added.

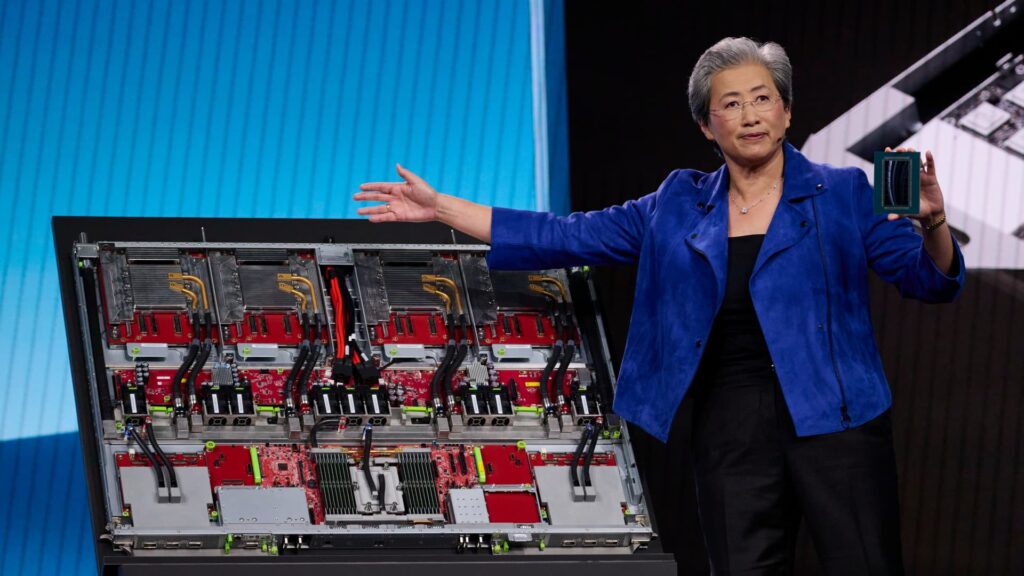

The chipmaker signed a deal with OpenAI in October that could give the startup a 10% stake in AMD. OpenAI plans to deploy 6 gigawatts of AMD’s Instinct graphics processing units over multiple years, starting with an initial 1 gigawatt chip deployment in the second half of 2026, the companies said.

oracle Also announced in October that it plans to deploy 50,000 AMD AI chips starting in the second half of this year.