Treasury Secretary Scott Bessent sparred with Democratic members of the House Financial Services Committee on Wednesday and was criticized by some as “clumsy” for not criticizing United Arab Emirates officials’ investments in the Trump family’s cryptocurrency venture.

Representative Gregory Meeks of New York grilled Bessent over alleged conflicts of interest and lack of transparency related to World Liberty Financial, which was co-founded by President Trump’s family.

“When a foreign-affiliated investor invests hundreds of millions of dollars in a company run by the president’s family, and at the same time the president is conducting foreign policy with that country… that raises national security concerns,” Meeks said.

Mr. Meeks called on Mr. Bessent to undertake a thorough investigation into “conflicts of interest and foreign influence” and to suspend bank licenses and applications to the Office of the Comptroller of the Currency, an independent agency within the Treasury Department that regulates banks.

“The OCC is an independent organization,” Mr. Bessent said, over Mr. Meeks’ cries and without touching on the topic further.

“Stop protecting the president. Stop trying to please the president,” Meeks said.

The Wall Street Journal reported on Saturday that the UAE’s royal family and government officials bought $500 million in stock in World Liberty Financial last year. President Donald Trump and his envoy Steve Witkoff are honorary co-founders of the company, which is run by members of the Trump and Witkoff families.

“I don’t know about that,” Trump told CNBC in the Oval Office on Monday when asked about the UAE investment.

“I know crypto is a big thing and they love it. A lot of people love it. The people behind me love it. My sons are working on it. My family is working on it. They’re probably getting investments from different people,” the president continued, referring to attendees standing behind him at the event.

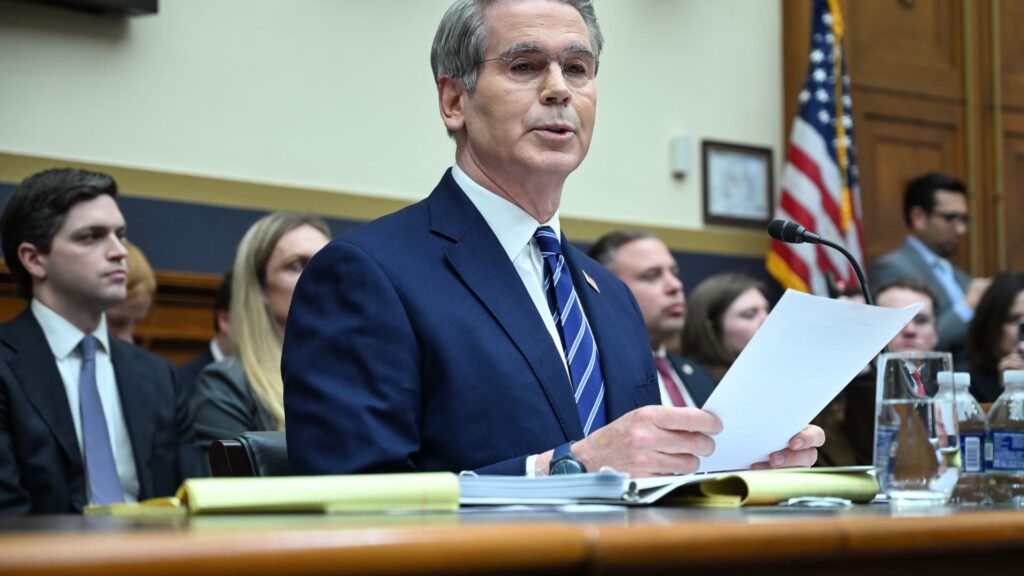

U.S. Treasury Secretary Scott Bessent testifies during the House Financial Services Committee hearing on the Annual Report of the Financial Stability Oversight Council on February 4, 2026, at the Capitol in Washington, DC.

Alex Roblewski AFP | Getty Images

Mr. Bessent’s appearance before the House committee was the first of two scheduled on the Hill this week. He is scheduled to appear before the Senate Banking, Housing and Urban Affairs Committee on Thursday.

In his testimony, Bessent characterized the Biden-era approach as “reflexive regulation” that hinders financial institutions and warned against overregulation.

“In adjusting regulations, federal agencies must avoid the temptation to create a zero-risk financial system that would result in what others have called ‘graveyard stability,'” Bessent said. The Financial Stability Oversight Council (Financial Stability Oversight Council) states that “before recommending additional regulation, it should aim to identify vulnerabilities that could lead to systemic crisis and encourage the private sector to mitigate those risks.”

Democrats also pressed the secretary on inflation, housing affordability and regulation of cryptocurrencies, but Bessent took a combative stance.

Mr. Bessent has been asked several times to comment on the independence of the Federal Reserve, a controversial issue that has been targeted by Mr. Trump and his allies for months over Fed Chairman Jerome Powell’s refusal to cut interest rates as much as the president wants. Mr. Powell alarmed Trump’s critics on January 11 when he revealed that he was the subject of an unprecedented investigation by the Justice Department into cost overruns at Federal Reserve headquarters.

“I believe in the independence of the Federal Reserve, but I also believe in accountability,” Bessent told lawmakers. But that independence was threatened because “the Federal Reserve lost the confidence of the American people by allowing the highest inflation in 49 years and hurting this nation’s workers.”

President Trump doubled down on the investigation this week, with Republican Sen. Thom Tillis vowing to block the nomination of Kevin Warsh, the president’s nominee to replace Powell, unless the investigation is closed. Powell’s term ends in May.

House Financial Services Leader Maxine Waters (D-Calif.) called the Justice Department’s case against Powell “a baseless criminal investigation designed to bully the Federal Reserve into serving President Trump’s policies rather than the American people.”

In another tense exchange, Mr. Waters pressed Mr. Bessent on whether tariffs would lead to inflation.

Not so, Bessent said, citing a report from the Federal Reserve Bank of San Francisco. Instead, they cited immigration as an explanation for inflation, particularly in the housing and rental markets. He cited another study from the Wharton School of the University of Pennsylvania that found the influx of immigrants contributes to rising housing costs.

Waters called on the Treasury secretary to be a “voice of reason” in the administration on affordability issues, as Bessent ignored her question and spoke on her behalf.

“Can you please shut him up?” Waters apparently asked the French Hill R.A.C. president.

“Can you maintain some decency?” Mr. Bessent answered.

—CNBC’s Eamon Javers and Garrett Downs contributed to this report.