The move is another effort by the Trump administration to tighten control over the Federal Reserve, which has historically been out of touch with day-to-day politics.

Published December 3, 2025

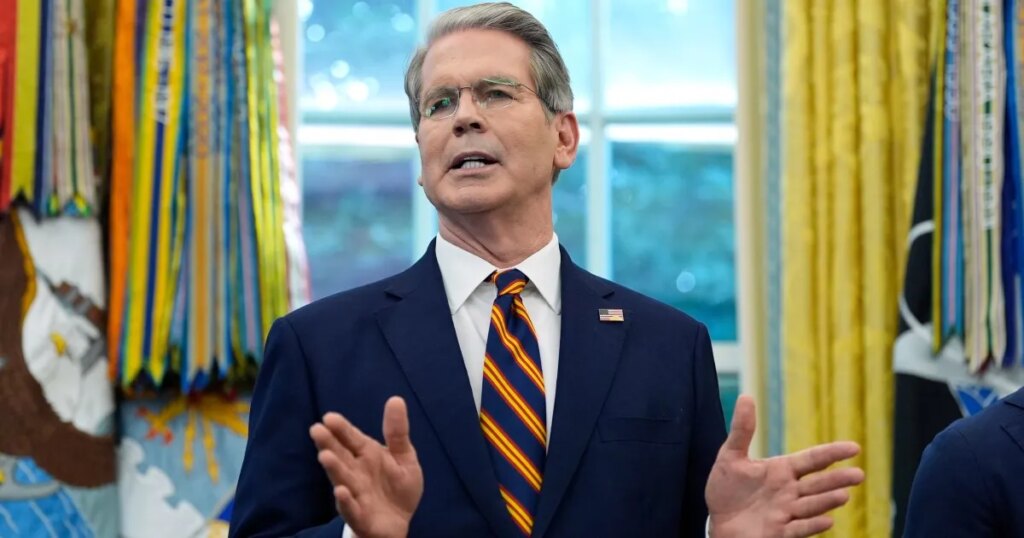

Treasury Secretary Scott Bessent has said he will push for a new requirement for Federal Reserve regional bank presidents to reside in the District for at least three years before taking office, potentially giving the White House more power over the independent agency.

“There’s a disconnect with the Federal Reserve framework,” Bessent said in comments at the New York Times’ Dealbook Summit on Wednesday, adding, “Unless someone has lived in the district for three years, we’re going to veto them.”

Recommended stories

list of 4 itemsend of list

Mr. Bessent has become increasingly critical of the Fed in recent weeks after several of the Fed’s 12 regional bank presidents announced in a series of speeches that they opposed cutting the Fed’s key policy rate at its next meeting in December. President Donald Trump harshly criticized the Federal Reserve for not lowering short-term interest rates sooner. When the Fed lowers interest rates, borrowing costs for mortgages, auto loans, and credit cards can decrease over time.

The possibility of the administration vetoing local bank presidents would mean it would further strengthen its control over the Federal Reserve, an institution traditionally independent from day-to-day politics.

The Fed tries to keep prices down and support employment by setting short-term interest rates that affect borrowing costs across the economy.

complex structure

The Federal Reserve has a complex structure that includes a seven-member board of directors based in Washington and 12 regional banks covering specific regions around the country. The system, enshrined in the Federal Reserve Act, was designed to ensure that the U.S. central bank’s policy reflected input from officials across the country, not just political appointees based in Washington.

The Federal Reserve Act does not impose residency requirements on local bank presidents. Regional Feds have repeatedly maintained that merit and ability were the driving force in their decisions when selecting new leaders.

Seven governors and the president of the New York Fed vote on all interest rate decisions, but four of the remaining 11 presidents vote on a rotating basis. However, all presidents participate in meetings of the Fed’s rate-setting committee.

Bessent, who is currently selecting a candidate to recommend to President Trump to succeed Federal Reserve Chairman Jerome Powell, said the fact that many of the current regional bank presidents are hired from outside their constituencies goes against the spirit of how the U.S. central bank was designed.

In an interview with CNBC last month, Mr. Bessent argued that the reason for creating the regional fed banks was to bring a local perspective to the Fed’s interest rate decisions and “break the New York stereotype” of setting interest rates.

But now, he said last month, “three, maybe four” of the Fed’s presidents have been appointed from outside the district, some of whom live in New York.

“I don’t know if the Federal Reserve was designed that way,” Bessent said in an interview.