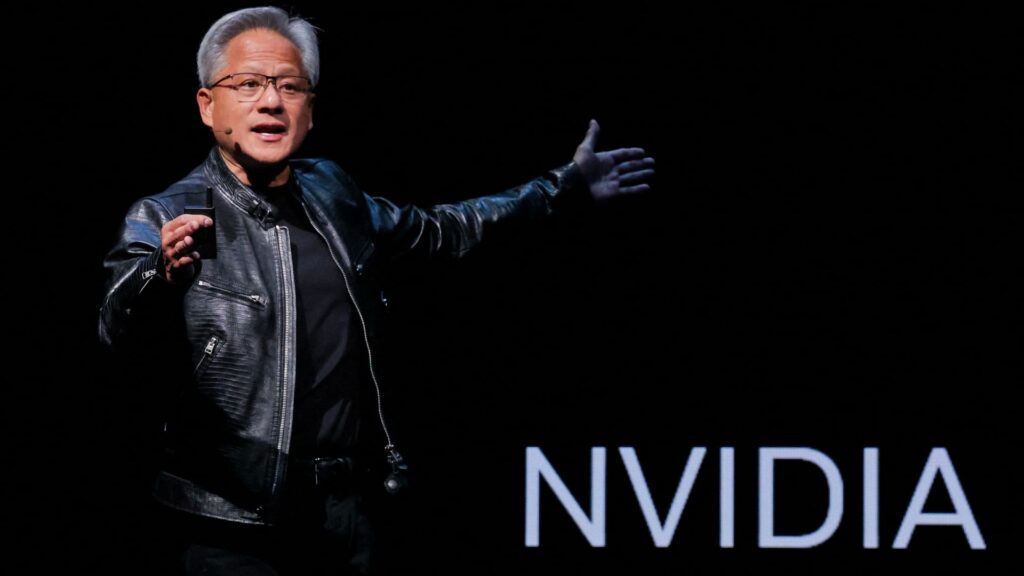

CNBC’s Jim Cramer said Tuesday that Nvidia stock’s drop to a nearly three-month low is a buying opportunity for investors. Shares of the AI chip manufacturing king fell 6% in morning trading after The Information reported that Meta Platforms is considering using Google’s tensor processing units (TPUs) in its data centers in 2027. NVIDIA stock has also fallen recently, as concerns about AI companies’ valuations and huge data center spending commitments weigh on tech stocks and the broader market. When asked on “Squawk on the Street” if he would inject new money into NVIDIA, Cramer said, “Yes, I think NVIDIA is being neglected here.” He noted that NVIDIA reported a strong quarter last week and confirmed orders for its Blackwell and next-generation Vera Rubin chip platforms are on track to reach $500 billion. He added that Nvidia is trading at a low price-to-earnings ratio. NVDA YTD Mountain Nvidia YTD Alphabet-owned Google’s TPU has received renewed attention since the release of Gemini 3 last week. Gemini 3 stands out from other artificial intelligence models and was trained on a custom chip co-designed with Broadcom. “I don’t see customers running away from the stock,” Cramer, a longtime proponent of “owning, not trading” Nvidia stock, said on Tuesday. “I see some customers being price sensitive.” He argued that such price sensitivity will not drive down the price of Nvidia’s graphics processing units (GPUs), which are recognized as the gold standard for running AI workloads. “When demand goes away, prices go down,” Kramer said. “The demand is insatiable for NVIDIA.” Cramer’s Charitable Trust, a stock portfolio used by CNBC Investing Club, owns Nvidia, Meta, and Broadcom.