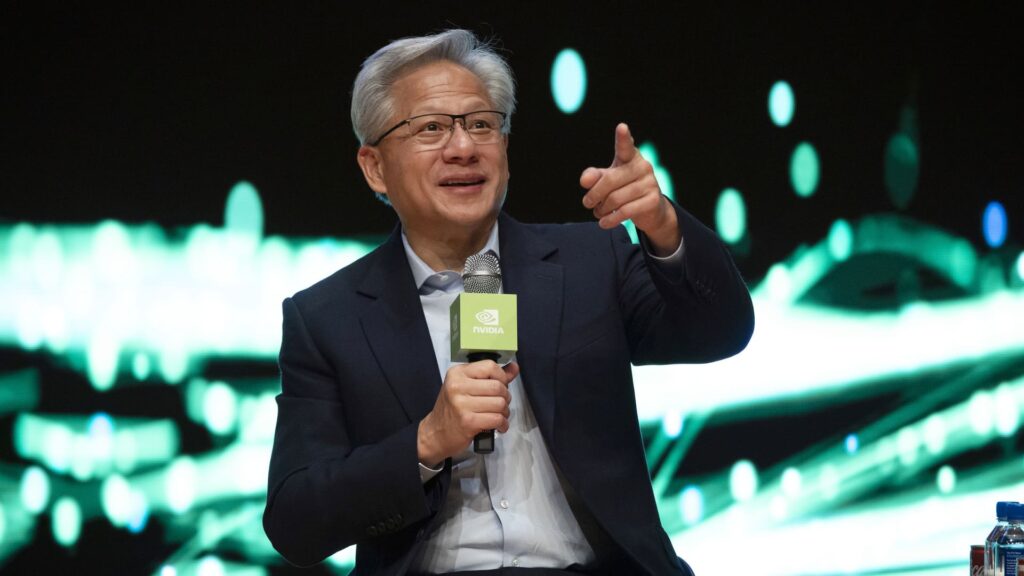

My Top 10 Things to Watch Monday, January 5th 1. The S&P 500 is on track to rise this morning despite the US attack on Venezuela over the weekend and the detention of President Nicolas Maduro. Looking ahead, Wall Street is awaiting the release of the December jobs report on Friday. 2. Oil prices rose slightly this morning following the ouster of President Maduro. But don’t get carried away. Yes, Chevron, the only major U.S. oil company operating in this country, is the winner. Bernstein raised its price target by $2 to $172 and left its rating unchanged. But the only loser may be China, given that infrastructure requires billions of dollars and Venezuelan oil is heavy. The Chinese refine it, and we can refine it too. Expect it to be repurposed for us. This will force China to either pay more or cancel the $50 billion it owed Venezuela. Proved reserves may not be realized. Even though Iraq had a more viable infrastructure, it took more than eight years to get back from 2 million barrels per day (bpd) to 4 million barrels per day (bpd). 3. Nvidia CEO Jensen Huang will open CES 2026 at 4pm ET in Las Vegas with a keynote address. He will discuss the Fourth Industrial Revolution and Nvidia’s role in accelerated computing and full-stack solutions (meaning hardware and software). Also, multiple PT increases are expected. Will this be the year we stop talking about circular investing and start realizing that Nvidia is investing in every major company and therefore has a huge advantage over everyone else?Additionally, Nvidia has acquired as much high bandwidth memory (HBM) as it needs (which explains Micron’s steady rise) and Chinese tech companies have sold over 2 million H200s. Chip orders put the lie to the notion that Chinese demand was weak. Who would tell such a lie about light demand? Many of these lies and endless chatter about circular spending. 4. I sought to address many of these misconceptions in Sunday’s column and made the case for owning AI stocks again in 2026. The biggest reason I’m optimistic about hyperscalers is power gating. Because they can’t invest as fast and as much as they want. Look for OpenAI to raise $100 billion, following SoftBank’s $40 billion investment. 5. Barclays announced significant price target increases for major banks as part of its 2026 outlook. The winner again was Citigroup, just like in 2025. Still, analysts raised the Goldman Sachs holding club’s PT from $850 to $1,048. Wells Fargo, another club name, was raised from $94 to $113. Barclays maintained its investment rating on all three stocks as “buy.” 6. Guggenheim upgraded Palo Alto Networks to Hold Sell with no price target. Analysts note that the club’s stock’s recent poor performance makes it difficult to make money shorting Palo Alto at this point. But Guggenheim believes cybersecurity groups are “to some degree isolated, if not enhanced by the threat of AI.” Another cyber name for the club is CrowdStrike. 7. Will AI stop putting pressure on software-as-a-service (SaaS) companies? Questions remain, but RBC Capital raised Salesforce’s PT from $250 to $290 and maintained a Hold rating. Analysts predict that 2026 will be the year in which AI tailwinds become more pronounced for companies well-positioned to adopt enterprise AI, while those that are not ready may struggle. 8. Mizuho lowered Honeywell’s price target from $250 to $240, but maintained its Buy rating on the stock. Analysts say the “roads ahead are uneven” for the multi-industry group, but say the “tariff fog” is clearing. I think this will be Honeywell’s year for the club as Honeywell completes its split into aerospace and automation. 9. Bank of America raises its price target for GE Healthcare from $82 to $92. I think this is the wrong call. This company won’t make as much money as the street expects. 10. Goldman Sachs upgraded Coinbase stock from hold to buy and raised its price target from $294 to $303. Analysts see the stock as a “best-in-class play” in crypto infrastructure growth. The stock is up more than 4% premarket. Sign up for free for my Top 10 Morning Thoughts on the Markets email newsletter (See here for a complete list of Jim Cramer Charitable Trust stocks.) As a subscriber to Jim Cramer’s CNBC Investment Club, you’ll receive trade alerts before Jim makes a trade. After Jim sends a trade alert, he waits 45 minutes before buying or selling stocks in his charitable trust’s portfolio. If Jim talks about a stock on CNBC TV, he will issue a trade alert and then wait 72 hours before executing the trade. The above investment club information is subject to our Terms of Use and Privacy Policy, along with our disclaimer. No fiduciary duties or obligations exist or arise from your receipt of information provided in connection with the Investment Club. No specific results or benefits are guaranteed.