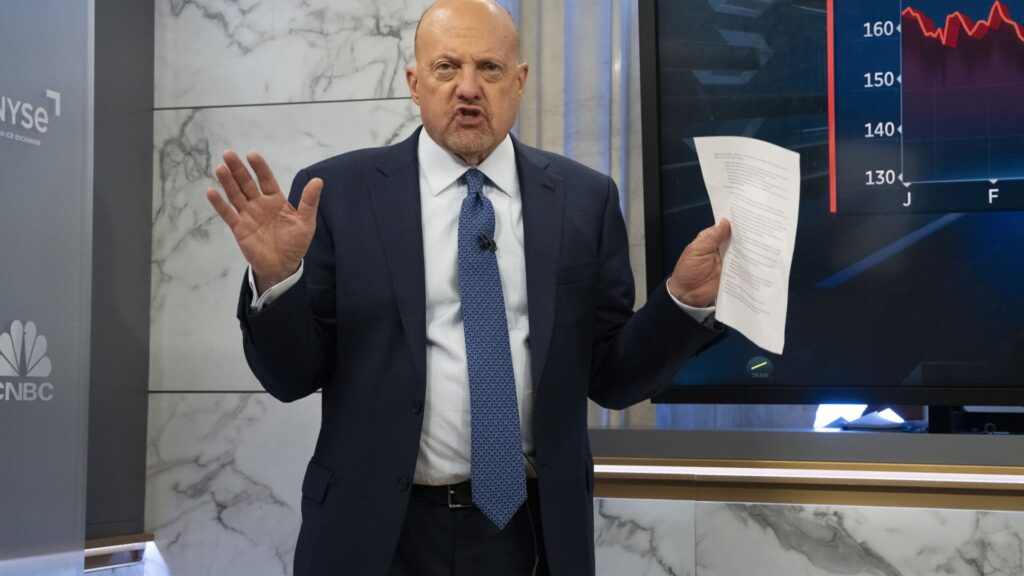

CNBC’s Jim Cramer said Tuesday that early January trading shows how quickly emotion can dominate markets at the beginning of the year, and warned investors not to confuse momentum with durability.

Kramer said the market is driven by three groups. One is the momentum traders chasing last year’s winners, the “everlasting hope” investors buying battered stocks, and the companies that shouldn’t have been late in the first place.

“These trends continued for 10 business days into the year, and we didn’t see any major corrections,” Kramer said. “I wouldn’t be surprised if it happened again.”

Cramer cited the recent sell-off in oil stocks after Venezuela’s political upheaval as an alarming example, saying investors rushed in only to see buyers disappear and sellers to overwhelm the market.

Momentum traders are currently rushing into data storage stocks due to the explosion in demand driven by artificial intelligence, he said. shares of western digital, sandisk, seagate and micron Stocks are soaring as the shortage drives up prices and short sellers scramble to cover.

This rise also led to gains in chip equipment manufacturers, including: ram research, applied materials and KLA. But Cramer warned that emotional buying could become irrational and quickly reverse once supply catches up.

Beyond tech, Kramer said bank stocks will gain more in 2025 due to deregulation and a rebound in trading. He cited his strengths as: goldman sachs, capital one and citygroupHe noted that valuations have expanded after years of pressure.

Kramer also flagged the following comebacks. nike and starbucksHe pointed to Nike’s insider buying as a sign that management believes the worst is over.

But the opportunities he prefers are what he calls “mistaken identity stocks”; Amazon.

Kramer said Amazon’s recent poor performance gives the false impression that something is wrong, despite strong growth across its cloud, retail and advertising businesses.

Of the three categories, Kramer said misidentified stocks offer the best risk-reward at the beginning of the year.

“If you get a big profit…don’t be greedy,” Kramer says.