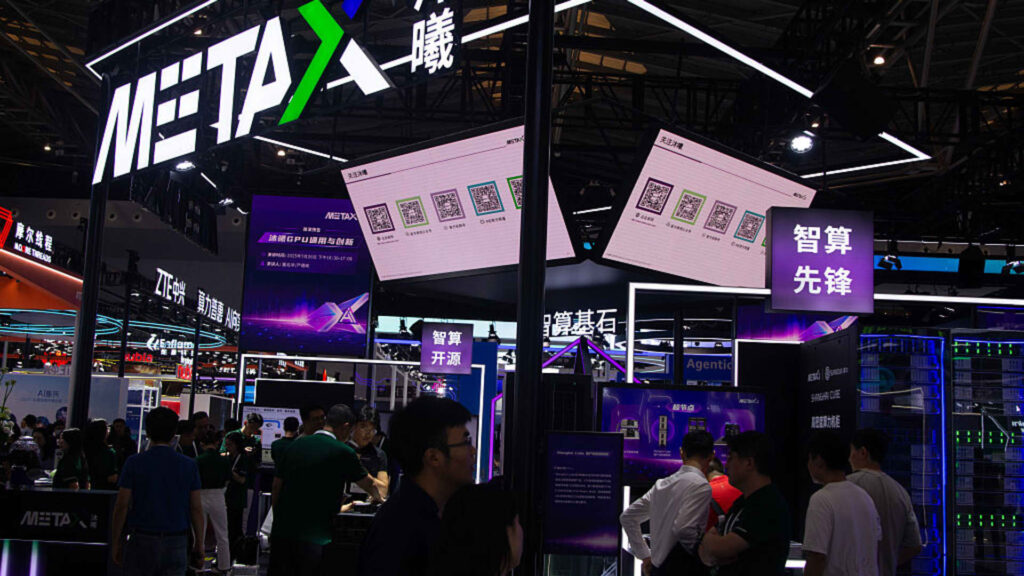

July 26, 2025, MetaX booth at Shanghai New Expo Center in Shanghai, China. (Photo by Ying Tang/NurPhoto, Getty Images)

Null Photo | Null Photo | Getty Images

It felt like déjà vu when chipmaker MetaX Integrated Circuits’ stock price soared 700% in its Shanghai market debut on Wednesday. Moore Thread soared more than 400% on its first day of trading just two weeks ago.

These are the latest Chinese AI chip companies that investors in the country are pouring money into as they race to develop their own chips and challenge Nvidia’s dominance in the face of U.S. export restrictions.

Both are manufactured by Nvidia and develop graphics processing units (GPUs), a type of chip used for advanced AI.

Investor enthusiasm for China’s AI chip IPOs is partly shaped by long-term expectations that China will build a self-sufficient semiconductor ecosystem amid ongoing tensions with the United States, Macquarie equity analyst Eugene Xiao told CNBC.

Washington has banned the sale of Nvidia’s cutting-edge semiconductors to the country. The Financial Times reported earlier this month that U.S. President Donald Trump is easing export restrictions on some of Nvidia’s chips, while Nvidia’s regulators plan to restrict access to the company’s processors, as the company seeks to exit overseas technology in the AI race.

Chinese AI chip makers, including tech giants like Huawei, Alibaba and Baidu, have so far failed to develop processors that rival Nvidia’s most advanced processors.

However, while significant barriers to overcoming export control regulations remain in some areas of the chip supply chain, such as equipment, significant progress has been made in other areas, such as memory.

Let’s take a look at how China’s AI chip Nvidia’s rival market is shaping up.

huawei

Privately held technology giant Huawei is developing the Ascend series of chips, whose next-generation model, the 950, is scheduled to be released in 2026. “Competition is definitely here,” NVIDIA told CNBC when announcing the new system.

The company’s previous Ascend model wasn’t expected to compete with Nvidia on a chip-by-chip basis, but by linking more processors together, Huawei was able to build high-performance “clusters” that rivaled the U.S. chipmaker’s most advanced systems.

“This strategy relies on high-speed, potentially optical interconnects to quickly move data between large clusters. This setup suits China’s current strengths because it does not require top-end chips,” Brady Wang, associate director at Counterpoint Research, told CNBC in November.

Baidu

Baidu, China’s largest search platform, is pouring more and more resources into AI and is a major shareholder in chip designer Kunlunxin. In November, the company announced a five-year roadmap for its Kunlun AI chip, announcing new processors in 2026 and 2027.

Nasdaq-listed Baidu uses a combination of homegrown chips and Nvidia products to run its in-house AI models in its data centers. The company seeks to position itself as a “full stack” provider that produces chips, servers, data centers, and AI models and applications.

“Kunlunxin has emerged as one of the country’s leading AI chip developers, focusing on large-scale language model (LLM) training and inference, cloud computing, and high-performance AI chips for communications and enterprise workloads,” Deutsche Bank analysts said in a November note.

JPMorgan said in a November note that it views the Kunlun AI chip as one of the chips “best positioned” as Chinese hyperscalers increase sourcing from local solution providers.

alibaba

E-commerce giant Alibaba (sometimes compared to Amazon because it is one of the largest local cloud providers) began developing AI chips in the late 2010s. In August, CNBC reported that the company was developing a new AI chip that would focus on inference rather than training.

Alibaba’s stock price rose in September following reports that the company had secured a major customer for its AI chips.

Morningstar analyst Chelsea Tam said in September that “improved performance of internally developed chips” was one of the factors supporting revenue growth in Alibaba’s cloud division.

cambricon

Cambricon, which develops chips for AI training and inference, posted record profits in the first half of 2025 as revenue soared. The semiconductor maker, founded in 2016, announced that its sales increased more than 4,000% year-on-year to 2.88 billion Chinese yuan ($402.7 million), while net profit reached a record high of 1.04 billion yuan.

“We see Cambricon as the strongest winner in China’s AI accelerator market, although it is still in its early stages compared to the U.S. market due to chip accessibility issues,” Jamie Mills O’Brien, investment director at Investment Group Aberdeen, told CNBC in an email.

“We expect multiple hurdles to be resolved over the next year or two, including fab maturation, customer acceptance, and ecosystem formation, which will likely make Cambricon a ‘good enough’ alternative to NVIDIA’s downgraded chips in China.”

Illustrated photo showing Moore Threads logo on a smartphone in Suqian, Jiangsu Province, China, October 30, 2025.

Photo | Future Publishing | Getty Images

Other AI chip companies

MetaX on Wednesday raised nearly $600 million in an initial public offering, five years after it was founded by former AMD executive Chen Weiliang.

Founded in 2020 by the former general manager of Nvidia’s China division, Moore Threads is sometimes referred to as the “Nvidia of China.”

The company plans to unveil its latest GPU architecture at a developer conference in Beijing later this week, the South China Morning Post reports.

At the time of its listing, the company said it needed the IPO proceeds to accelerate core research and development initiatives, including production of new homegrown AI training and inference GPU chips.

Enflame was founded in 2018 by former AMD employees and designs chips for data centers with a focus on AI training and processes.

Biren Technology, which was founded in 2019 and designs high-performance GPUs, received approval for an IPO from Chinese regulators on Tuesday, Reuters and the South China Morning Post reported.