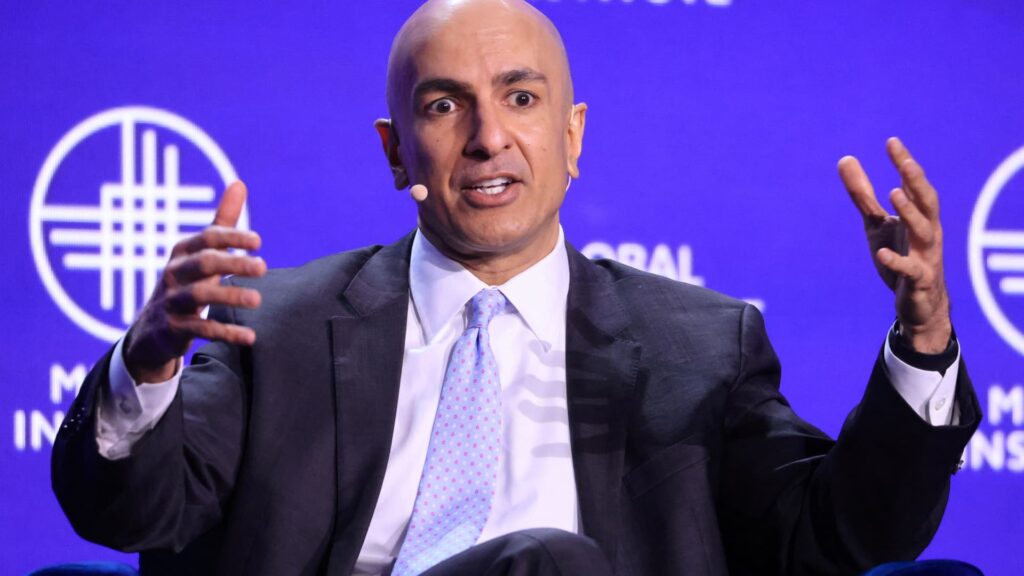

Minneapolis Fed President Kashkari said Monday that he believes the central bank is close to stopping rate cuts.

The central bank president said in an interview with CNBC that the key calculation now is whether the Fed should focus more on a slowing labor market or persistently high inflation.

“I think we’re pretty close to neutrality at this point,” Kashkari said in an interview on CNBC’s “Squawk Box.” “We need to get more data to know which is the bigger force. Is it inflation or the labor market? Then we can move from a neutral position in whatever direction we need to go.”

Adjusting for neutrality is critical for Fed policymakers because the group that will decide whether to continue with the third consecutive rate cut that will take place in the second half of 2025 or maintain the status quo while policymakers wait to see how economic conditions develop is critical for Fed policymakers.

The key federal funds rate is currently targeted at a range of 3.5% to 3.75%. This is only about half a percentage point from the committee’s consensus for a neutral interest rate, an interest rate that neither supports nor restrains growth, according to projections made at its December meeting.

“I think inflation is still too high, and the big question in my mind is how much monetary policy will tighten,” Kashkari said. “For the past few years, we kept thinking the economy was going to slow, but the economy has proven to be much more resilient than I expected. This shows that monetary policy shouldn’t be putting as much downward pressure on the economy.”

Kashkari’s voice will carry some weight in 2026 because he is a voting member of the Federal Open Market Committee, which sets benchmark interest rates. He recently said he would oppose the latest cuts, concerned about inflation that could still be affected by President Donald Trump’s tariffs.

He said he was concerned about the labor market, but acknowledged the committee’s work was nearing completion on cuts. The unemployment rate has risen to 4.6% this year, and the most recent measure of core inflation recommended by the Fed was 2.8%, although data whose accuracy has been called into question due to the government shutdown.

“The inflation risk is one of persistence, and it will take multiple years for the effects of these tariffs to filter through the system, but I think there is a risk that unemployment will spike from here,” Kashkari said.

On a separate matter, Kashkari said he would be happy if Jerome Powell remained on the board after his term as chairman ends in May. Although it is certain that he will be replaced as chairman, his term as governor will continue until January 2028.

“I don’t know if he’s going to stay or not. I think he’s done a great job as chairman. None of us are perfect. I don’t think he’s perfect. I’m not perfect. As a committee, we’re not perfect,” Kashkari said. “But overall, I think he’s done a great job and I’d like to see him stay as a colleague for as long as he wants.”

President Trump has indicated that he intends to name a successor to Powell in January.

Correction: The Fed has cut interest rates for the third time in a row in the second half of 2025. Previous versions listed the year incorrectly.