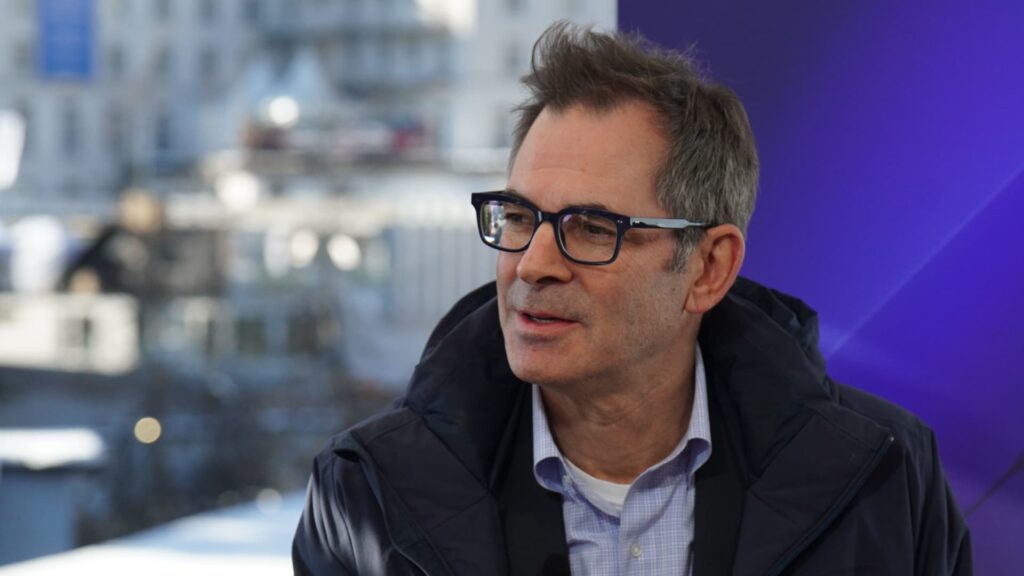

Coreweave CEO Michael Intrater speaks on CNBC’s Squawk Box at the World Economic Forum in Davos, Switzerland on January 20, 2026.

Oscar Molina CNBC

shares of coreweave It then rose 12% on Monday. Nvidia announced that it has invested $2 billion in an artificial intelligence infrastructure provider.

According to the release, Nvidia purchased CoreWeave Class A common stock for $87.20 per share, a discount from Friday’s closing price of $92.98. The investment will help accelerate CoreWeave’s buildout of a “5 GW AI factory by 2030,” the companies said.

“This agreement allows us to accelerate our buildout, which will allow us to continue to diversify and reduce our dependence on specific clients as we expand into this additional data center capacity,” CoreWeave CEO Mike Intrater said Monday on CNBC’s “Squawk on the Street.”

Gigawatt is a unit of electricity that is becoming an increasingly popular metric for AI data center capacity. Five gigawatts is roughly equivalent to the annual electricity consumption of 4 million U.S. homes, according to a CNBC analysis of data from the Energy Information Administration.

“What you have to remember is that we invested $2 billion in CoreWeave, but we recognize that the amount of capital that we still need to raise to support that 5 gigawatts is very significant,” Nvidia CEO Jensen Huang told CNBC during an interview. “We are investing a fraction of the amount that ultimately needs to be delivered.”

CoreWeave primarily makes money by building and renting data centers equipped with Nvidia’s graphics processing units, which are critical for training models and running large-scale AI workloads. The company, labeled by some investors as a “neo-cloud,” plays a key role in an increasingly interconnected web of AI infrastructure partners.

Before Monday’s announcement, Nvidia was already a major backer of CoreWeave.

In September, CoreWeave disclosed orders worth at least $6.3 billion from Nvidia in a filing with the U.S. Securities and Exchange Commission. According to the contract, NVIDIA is “obligated to purchase any remaining unsold capacity through April 2032.”

CoreWeave went public on the Nasdaq in March, raising billions of dollars in debt and equity from Nvidia and others.

“We are in the early stages of building AI infrastructure, and the demand is just extraordinary,” Huang said Monday.

As AI startups race to build out computing infrastructure, CoreWeave continues its onslaught of deals. In September, the company announced it had agreed to provide Meta with $14.2 billion of AI cloud infrastructure, just days after expanding its contract with OpenAI to $22.4 billion.

But Coreweave’s stock price has been volatile in recent months, with some investors concerned that the company is taking on too much debt to fund multibillion-dollar deals.

Intrater told CNBC earlier this month that AI will eventually be incorporated into “everything we do” and that the technology will “continue to pay dividends for the next 100 years.”

“What you’re seeing is that baseload infrastructure is now being built at a pace that was historically unimaginable,” he said. “Companies like CoreWeave and others are building the infrastructure to be able to provide that to these customers.”

PRO: Watch the full CNBC interview with Nvidia CEO Jensen Huang and CoreWeave CEO Mike Intrator.