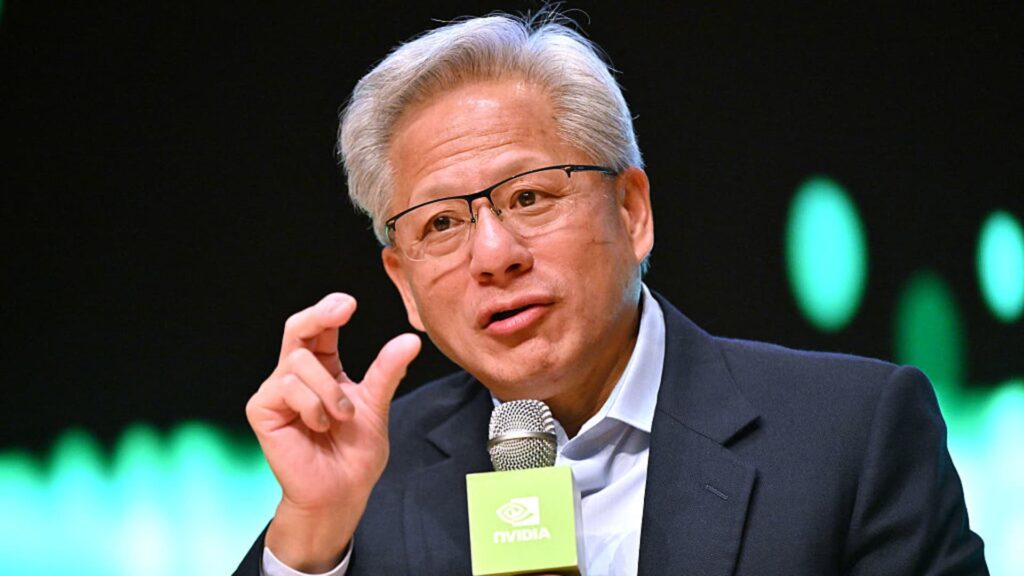

Nvidia founder and CEO Jensen Huang made this reaction during a press conference at the Asia-Pacific Economic Cooperation (APEC) CEO Summit in Gyeongju on October 31, 2025.

Jung Young Jae | AFP | Getty Images

artificial intelligence chip manufacturer Nvidia The company plans to announce its third quarter results after the market closes on Wednesday.

Here’s what Wall Street is expecting, according to LSEG consensus estimates.

EPS: $1.25 Revenue: $54.92 billion

Wall Street expects the chip maker to post earnings per share of $1.43 on revenue of $61.66 billion for the current quarter. Nvidia typically provides a quarter of its revenue guidance.

Anything Nvidia or CEO Jensen Huang says about the company’s outlook or sales balance will be closely scrutinized.

He’ll have a lot to talk about.

Nvidia is at the center of the AI boom, counting every major cloud company and AI lab among its customers. All major AI labs are using Nvidia chips to develop next-generation models, and a handful of companies called hyperscalers are spending hundreds of billions of dollars to build new data centers around Nvidia technology at an unprecedented scale.

Huang said last month that Nvidia’s chip orders will reach $500 billion from 2025 to 2026, including the next Rubin chip, which will begin shipping in volume next year. With all five of the top AI model developers in the US using the company’s chips, analysts will want to know more about what Nvidia has in store for the world of AI infrastructure next year.

As of Tuesday, analysts polled by LSEG expected NVIDIA’s revenue to rise 39% in the company’s 2027 fiscal year, which begins in early 2026.

Investors will want to hear about Nvidia’s stock deals with customers and suppliers, including its investment deal in OpenAI, its deal with Nokia, and its investment in former rival Intel. Nvidia continues its pace of signing deals, agreeing to invest $10 billion in AI company Anthropic earlier this week.

Nvidia executives will also be asked about China and the company’s chances of getting permission from the U.S. government to export its current generation of Blackwell AI chips to the country. Analysts say Nvidia’s revenue could increase by up to $50 billion a year if it is allowed to sell its current generation of chips to Chinese companies.

WATCH: Nvidia’s earnings have a lot to offer, says Interactive Brokers’ Sosnick