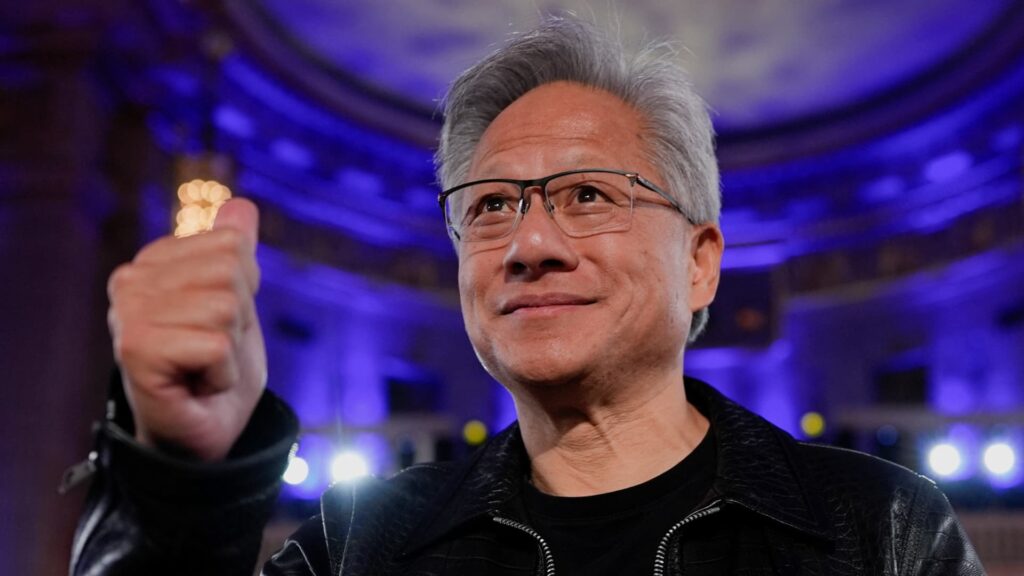

Nvidia CEO Jensen Huang gestures as U.S. President Donald Trump (not pictured) speaks at the “Win the AI Race” summit in Washington, DC, USA on July 23, 2025.

Kent Nishimura | Reuters

shares of Nvidia rose more than 3% in pre-market Wednesday, putting the tech giant on track to become the first company to pass the $5 trillion market cap threshold.

This extraordinary milestone will reflect the company’s impressive growth from a niche video game processor to an essential player in the artificial intelligence boom.

Nvidia stock was last seen rising 3.1% premarket. Shares closed up 5% in pre-market trading, but are up nearly 50% year-to-date.

The rise comes shortly after CEO Jensen Huang said Nvidia expects $500 billion in orders for AI chips and announced plans to build seven new supercomputers for the U.S. government.

Separately, Nvidia announced on Tuesday that it would acquire $1 billion in stock. nokiaformed a strategic partnership with a network company to develop next-generation 6G cellular technology.

Buoyed by AI trade, U.S. stocks rose to record highs on Tuesday. Major averages have been boosted by advances in technology. apple and microsoft After the stock price rise, the market value of both companies reached more than $4 trillion.

The dizzying rise in U.S. stocks comes despite persistent concerns about a bubble, especially as AI-driven spending has led to record trading and valuations.

Earlier this month, the International Monetary Fund and the Bank of England became the latest financial institutions to warn that global stock markets could be in trouble if investor appetite for AI deteriorates.

Ark Invest CEO Cathie Wood on Tuesday warned of the possibility of a “reality check” on AI ratings in the near future, but dismissed fears of an AI bubble.

“If our predictions about AI are correct, we are at the very beginning of a technology revolution,” Wood told CNBC on the sidelines of Saudi Arabia’s Future Investment Initiative (FII) in Riyadh.