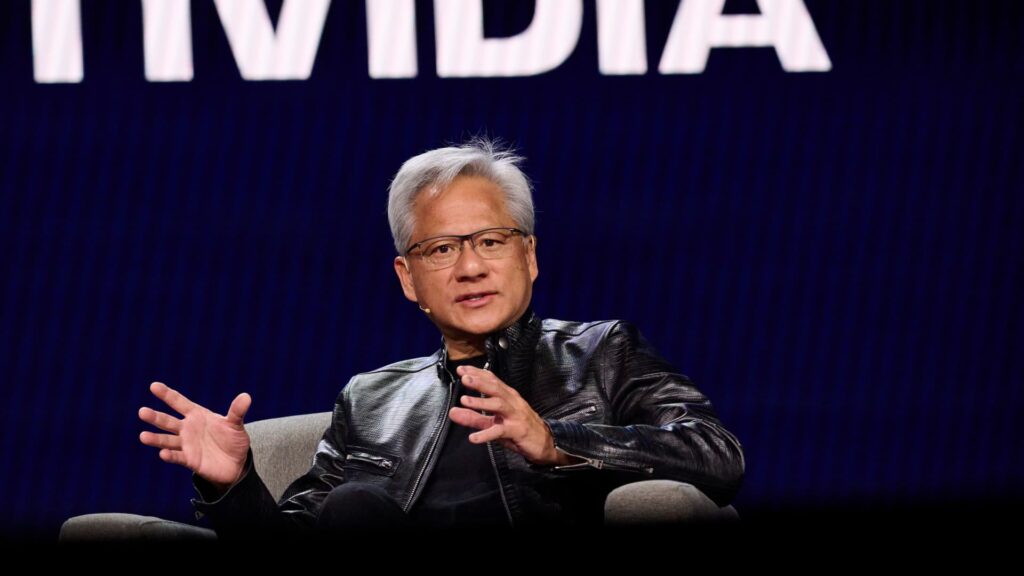

Jensen Huang doesn’t seem fazed by his expected $7.75 billion tax bill.

That’s what the CEO of NVIDIA could end up owed to the state of California if the proposed ballot measure succeeds in imposing a one-time 5% wealth tax on the state’s billionaires. Hwang, who is the ninth richest person in the world with a net worth of $155 billion, according to Bloomberg estimates on Jan. 6, told Bloomberg TV on Tuesday that he would be “absolutely fine” with that outcome.

“I have to say, I’ve never thought about it,” Huang, 62, said when asked if the proposed tax would concern him. “We choose to live in Silicon Valley, and whatever taxes they apply, that’s fine with me. I’m totally fine with that.”

The ballot initiative, proposed by health care workers unions in November and supported by California Democratic Rep. Ro Khanna and Sen. Bernie Sanders and others, would impose a 5% tax on the total assets of California residents with a net worth of more than $1.1 billion as of early 2026. The initiative would direct that tax funding to California’s health care budget, which is facing a significant federal shortfall. Spending cuts and public school and food assistance programs.

Don’t miss: How to build a custom GPT and use AI agents

The initiative needs to collect more than 870,000 signatures to appear on the state’s November 2026 ballot, at which point California voters will decide whether to allow it to go into effect. If successful, billionaires currently living in California would be taxed on all valuable assets they own, including stocks and businesses, regardless of whether they move out of the state in 2026.

Real estate assets would be excluded from taxes because residents already pay property taxes, according to an analysis by California’s nonpartisan Legislative Analysis Service. Under the proposal, billionaires would be allowed to spread their payments over five years.

Supporters say the tax could ultimately raise about $100 billion from the state’s 200 wealthiest people, including Mr. Huang. The Nvidia CEO has never released a complete breakdown of his wealth, but Forbes estimates that the majority of his wealth comes from his approximately 3% ownership in Nvidia, which is currently valued at more than $4.6 trillion.

An Nvidia spokesperson declined to comment on CNBC Make It beyond what Huang said Tuesday.

“We work in Silicon Valley because the talent is concentrated there.”

Mr. Hwang has expressed indifference to the tax proposal, putting him at odds with many billionaires in the state and elsewhere. For example, Billionaire Anduril co-founder Palmer Lackey said in a Dec. 28 post on social media platform

“Right now, my co-founders and I need to come up with billions of dollars in cash somehow,” Lackey wrote.

Another billionaire, Vinod Khosla, a venture capitalist and co-founder of Sun Microsystems, suggested in a Dec. 28 post on X that he would persuade the wealthy to flee the state. On the contrary, supporters of the ballot initiative point to research that debunks the idea that raising taxes will result in significant out-migration of wealthy people and businesses.

Business leaders including Google co-founder Larry Page and venture capitalist Peter Thiel are reportedly considering leaving California by the end of 2025 to avoid the tax proposal, according to a Dec. 26 article in the New York Times. Since then, neither Mr. Page nor Mr. Thiel have publicly announced any changes to their personal residences, and spokespeople for each billionaire did not immediately respond to requests for comment.

Bill Ackman, a New York-based billionaire investor with the Pershing Square hedge fund, criticized wealth taxes more broadly in a Dec. 29 post on X, writing that a wealth tax is “effectively an expropriation of private property, with many unintended negative consequences.” Billionaire investor Mark Cuban, who says he is “proud to pay” a large amount of taxes each year, but opposes taxing unrealized capital gains, wrote that he “agreed” with Ackman’s post.

California Democratic Governor Gavin Newsom has also expressed opposition to a state-level wealth tax like the one proposed. If California’s initiative gathers enough signatures, Newsom and the state Legislature could try to block it from appearing on the November ballot by filing an emergency petition with the California Supreme Court.

But Huang asserted that he still considers Nvidia’s location in Santa Clara, California, to be a major advantage. “We work in Silicon Valley because that’s where the talent is,” he said. Typically, the biggest factor in deciding where a company will locate is the availability of qualified employees, he added.

“Where there is talent, there is always an office,” Huang said.

Want to use AI to advance your work? Sign up for CNBC’s new online course, Beyond the Basics: How to Use AI to Supercharge Your Work. Learn advanced AI skills like building custom GPTs and using AI agents to increase your productivity today. Use coupon code EARLYBIRD for 25% off. Offer valid from January 5th to January 19th, 2026. Terms and conditions apply.