Obamacare sign at an insurance agency in Miami, November 12, 2025.

Joe Radle | Getty Images

The White House on Thursday reiterated its support for sending direct benefits to households to cover health care costs, something President Donald Trump has championed for months.

But health policy experts CNBC spoke to said they were skeptical of the proposal.

“I think that’s a bad idea,” said Gerald Anderson, a professor of health policy and management at the Johns Hopkins Bloomberg School of Public Health.

The policy was part of a broader health care plan announced by the White House to lower drug prices and insurance premiums. In a video unveiling the framework, dubbed the “Great Health Care Plan,” President Trump called on Congress to quickly enact it into law.

President Trump has expressed enthusiasm for other direct payments during his second term, floating ideas such as tariff dividend checks.

Experts said it is difficult to assess the specific impact of direct health care payments because the White House framework lacks key details such as who would be eligible, how much consumers might receive and how that money would be used.

Broadly speaking, Anderson said, the proposal does not appear to give consumers the same level of financial assistance for their medical costs as they currently receive, and is likely to cause many people to drop their insurance and premiums to rise for remaining enrollees.

Nick Fabrizio, a health policy expert and associate professor at Cornell University’s Jeb E. Brooks School of Public Policy, said there also needs to be strong guardrails in place for people to decide how to spend their health care dollars.

“I feel very strongly that if you give people money, unless it’s something like a voucher, they’re going to spend it on things other than health care,” Fabrizio said.

Fabrizio said President Trump’s overall framework for policies such as increased price transparency in the health care ecosystem could be successful in reducing health care costs.

President Trump’s framework emerges in ACA subsidy debate

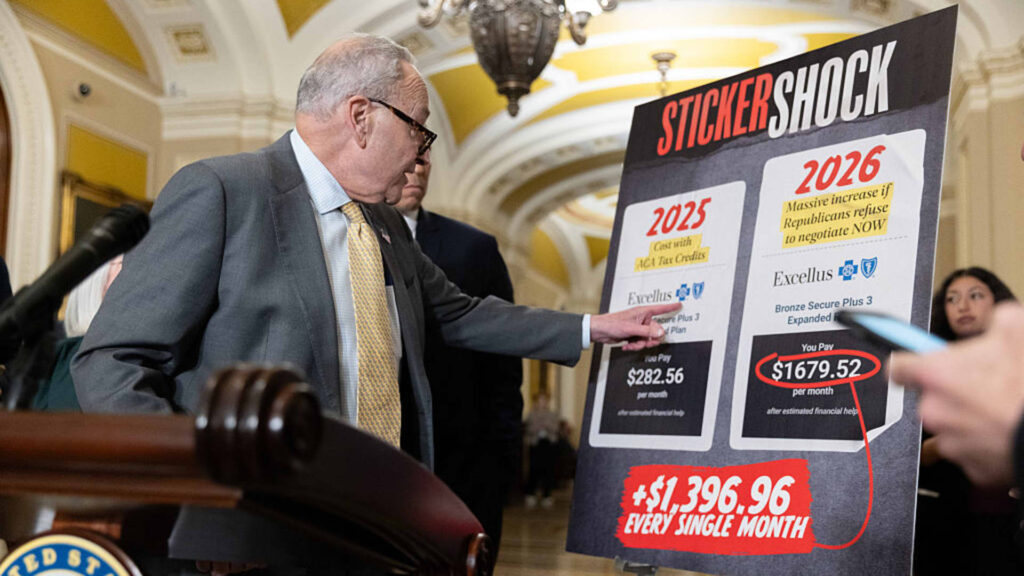

Senate Minority Leader Chuck Schumer (D-N.Y.) speaks at a press conference with other members of the Senate Democratic leadership after a policy luncheon at the Capitol on October 15, 2025.

Anadolu | Getty Images

The framework comes as Congress debates whether to extend enhanced subsidies that lower premiums for millions of Affordable Care Act marketplace enrollees, potentially complicating ongoing bipartisan efforts to renew them.

These enhanced subsidies, which have been in place since 2021, expired at the end of last year. KFF, a nonpartisan health policy research group, estimated that the expiration would more than double premiums for the average recipient.

Without the enhancements, ACA enrollees would still be subject to a baseline subsidy known as the premium tax credit.

Consumers can choose to receive these premium tax credits in one of two ways: receive them in a lump sum at tax time, or receive an immediate reduction in their monthly premiums.

In the latter scenario, by far the most common, the federal government sends consumer subsidies to insurance companies, which then lower consumers’ upfront premiums.

President Trump’s health framework called for an end to “billions of dollars in additional taxpayer-funded subsidy payments” and instead supported sending the funds “directly to eligible Americans so they can buy the health insurance of their choice.”

Experts say it’s unclear how such a plan would work.

Mr. Trump and some congressional Republicans previously supported the idea of eliminating some or all of the ACA subsidies and replacing them with something like contributions to health savings accounts, KFF’s Larry Levitt and Cynthia Cox write. A health savings account is a tax-advantaged account specifically for medical expenses.

White House officials said Thursday that consumers outside of the ACA markets will also be eligible for direct payments.

Although HSAs can be used to cover certain medical expenses, consumers cannot currently use them to pay for insurance premiums, and only consumers enrolled in eligible high-deductible health insurance plans can contribute to such accounts, experts said.

Matt McGaw, Affordable Care Act policy analyst at KFF, said if the ban on HSA premium payments remains in place, “it will create a higher hurdle to get people through the door and into an insurance plan.” “It doesn’t actually alleviate a lot of the (economic) burden for those people.

“The devil really is in the details,” he says.

Amounts are missing important details

Experts say other details are unclear, including the amount of direct payments and how much the remaining premium tax credit will be reduced.

If the amount isn’t large enough, Anderson said, people who are typically younger and healthier will opt out of insurance, leaving older and sicker enrollees behind. She said older and sicker members typically require more care, so insurers will likely raise premiums for the remaining insureds to compensate for that risk.

The bill, introduced in December by Sen. Mike Crapo (R-Idaho), chairman of the Senate Finance Committee, and Sen. Bill Cassidy (R-Louisiana), chairman of the Senate Health, Education, Labor and Pensions Committee, would provide annual HSA contributions of $1,000 for individuals ages 18 to 49 and $1,500 for individuals ages 50 to 64.

That amount “really pales in comparison” to the amount that many enrollees, especially those ages 50 to 64, received from enhanced ACA subsidies, McGough said.

For example, the average middle-income 60-year-old with an annual income of about $63,000 is no longer eligible for ACA subsidies and will have to pay the full unsubsidized premium (about $15,000) in 2026, according to KFF’s analysis. In 2025, this same individual was eligible for an ACA premium subsidy of approximately $7,300.

The amount of the premium tax credit varies widely from person to person based on age, income, and region.