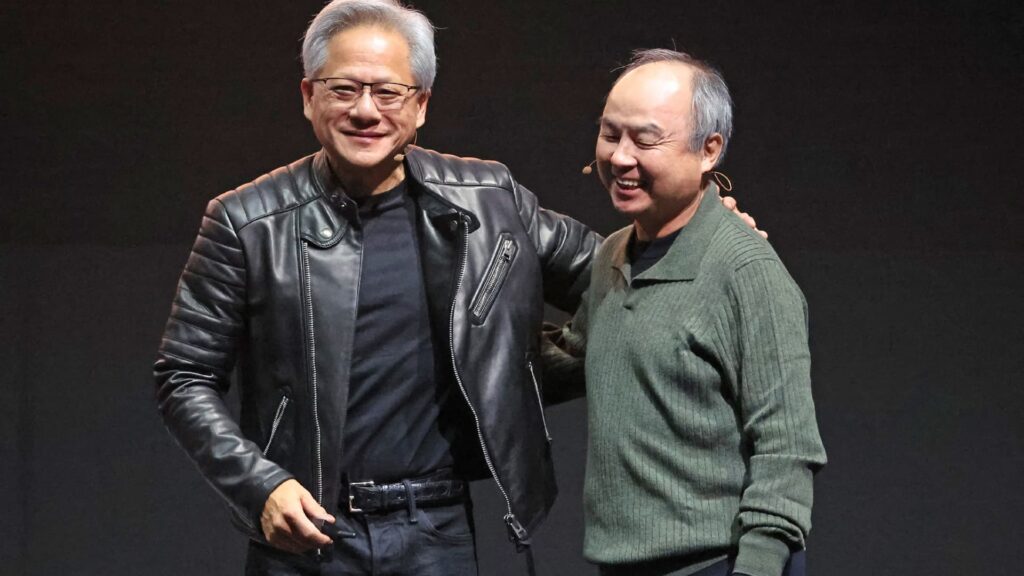

NVIDIA CEO Jensen Huang (left) and SoftBank Group CEO Masayoshi Son pose at an AI event held in Tokyo on November 13, 2024.

Akio Kon | Bloomberg | Getty Images

SoftBank announced Tuesday that it has sold its entire stake in the U.S. semiconductor maker. Nvidia The Japanese giant is looking to make the most of its “all-in” bet on ChatGPT maker OpenAI, which has sold for $5.83 billion.

In its financial results report, the company announced that it sold 32.1 million NVIDIA shares in October. It also announced that it had sold a portion of its T-Mobile shares for $9.17 billion.

SoftBank Chief Financial Officer Yoshimitsu Goto said in a presentation to investors, “While we can maintain our financial strength, we want to provide investors with many investment opportunities.”

“Through these options and tools, we ensure that we are ready to raise capital in a very secure manner,” he said in comments translated by the company, adding that the share sale was part of the company’s “asset monetization” strategy.

Nvidia stock fell 2% on Tuesday.

Sale of Nvidia stock, partial sale of T-Mobile stock, and margin loan on SoftBank stock holdings armare all “sources of cash used to fund a $22.5 billion investment in OpenAI,” a person familiar with the matter told CNBC. They added that the cash will fund other projects the company is working on, including its acquisition. ABBrobot unit.

The sale of Nvidia stock had nothing to do with concerns about artificial intelligence’s valuation, the person said.

Nvidia’s exit may come as a surprise to some investors, but it’s not the first time SoftBank has raised money from America’s AI chip darling.

SoftBank’s Vision Fund has been an early backer of Nvidia, reportedly selling its entire holding in January 2019 after amassing a $4 billion stake in 2017. Despite the latest sale, SoftBank’s business interests remain deeply intertwined with Nvidia.

The Tokyo-based company is involved in a number of AI ventures that rely on Nvidia technology, including the $500 billion Stargate project for U.S. data centers.

“In our view, this should not be seen as a cautious or negative attitude toward NVIDIA, but rather in the context of SoftBank needing at least $30.5 billion in capital for investments in the quarter, including $22.5 billion in OpenAI and $6.5 billion in Ampere,” Rolf Balck, equity research analyst at New Street Research, told CNBC.

That’s “more than the past two years’ combined investment in one quarter,” Bulk said.

Morningstar’s Dan Baker added that the move does not signal a fundamental shift in the company’s strategy.

“(SoftBank) emphasized that this is not their opinion on NVIDIA. After all, they are using the money to invest in other AI-related companies,” he said.

Vision Fund posts huge profit of $19 billion

The company doubled its second-quarter profit thanks to stock sales and a $19 billion windfall from SoftBank’s Vision Fund.

The Vision Fund is active in artificial intelligence, investing in and acquiring companies across the AI value chain, from chips to large-scale language models and robotics.

“We were able to achieve these results because we first invested in OpenAI in September last year,” says SoftBank’s Goto. He added that OpenAI’s latest valuation milestone of $500 billion is one of the largest valuations in the world according to fair value.

Following the recapitalization and SoftBank’s $22.5 billion investment in the ChatGPT maker, the Japanese company’s 4% ownership in OpenAI will increase to 11%.

Depending on the ChatGPT maker’s performance and evaluation of future rounds, SoftBank “may” further increase its investment in OpenAI, a person familiar with the matter told CNBC.

In general, SoftBank would not want to hold more than a 40% controlling stake, they said.

Softbank stock this year

Shares of Japanese conglomerates have fallen over the past week as concerns about an AI bubble spooked global markets.

“Our stock price has been moving up and down dynamically recently…We want to provide as many investment opportunities as possible,” Goto said on Tuesday, adding that the 4-for-1 stock split announced by the company is part of its strategy to provide shareholders with as many investment opportunities as possible.