charlie argen

Carl Goering | Deverpost | Getty Images

Wall Street has become increasingly enamored with the artificial intelligence boom this year, pouring money into chips, data centers and applications.

But investors who looked outside Silicon Valley found huge profits elsewhere: in space.

Some of this year’s biggest market winners were defense companies that benefited from renewed interest in space exploration and military reindustrialization. President Donald Trump’s military expansion plan includes a $175 billion “Golden Dome” project and efforts to boost U.S. shipbuilding.

In an effort to upgrade military technology and return astronauts to the moon for the first time in more than 50 years, the government is turning to companies outside of traditional defense companies. lockheed martin and Northrop Grumman. Recently appointed NASA Administrator Jared Isaacman told CNBC last week that President Trump’s recommitment to moon exploration is key to the “orbital economy.”

The bounty of space and defense has created opportunities for prominent private companies, including Palmer Lackey’s Anduril and Elon Musk’s SpaceX, which aims to go public next year. SpaceX is the parent company of satellite internet provider Starlink.

Among companies currently publicly traded, investors are focusing on satellite names, from traditional providers like EchoStar to startups like Planet Labs. These are among the few satellite stocks that have more than tripled in value this year.

planet lab

Will Marshall, co-founder and CEO of Planet Labs Inc., displays a model of the Dove satellite at the company’s headquarters in downtown San Francisco, California on Thursday, September 8, 2016. So the company is building shoebox-sized satellites to send into space to collect photos of Earth.

Michael McCaw | Getty Images

planet labThe San Francisco-based company has seen its stock rise nearly 400% this year, driven by growing demand for satellite imagery and space analytics. The company went public in 2021 through a special acquisition vehicle and is currently valued at $6.2 billion.

Planet Labs beat analyst expectations in its fiscal third-quarter earnings report this month and raised its guidance.

During this period, Planet Labs’ backlog more than tripled from a year ago. The company announced that it has launched two Pelican satellites and 36 Earth-imaging Superdove satellites since the end of this quarter.

In 2025, Planet Labs signed new government and defense agreements, including contracts with NATO and the European Space Agency. The company also renewed its partnership to provide Earth data to the U.S. Navy and won a $13.5 million task order for commercial satellite data with NASA.

Planet Labs works closely with the following companies: google About the Suncatcher project, which focuses on AI and machine learning in space. The company aims to launch two prototype satellites equipped with Google’s custom AI chips, called tensor processing units (TPUs), by early 2027.

echo star

echo starFounded in 1980 by Charlie Ergen, the company develops network, connectivity and satellite solutions under the Dish TV, Sling TV and Boost Mobile brands.

Pressure from regulators to build a 5G network has forced the company to sell its radio frequency rights. In August, EchoStar signed a $23 billion deal to sell spectrum licenses. AT&TThe following month, it sold $17 billion in spectrum rights to SpaceX to enhance Starlink connectivity.

SpaceX Executive Director Gwynne Shotwell said the partnership will help the company eliminate “mobile dead zones” and improve coverage for customers around the world.

cell phone tower company crown castle and american tower filed a lawsuit against EchoStar, claiming that the company was attempting to terminate the long-term contract following its spectrum contract.

EchoStar CEO Hamid Akhaban said on a call with analysts in November that the deal would give the company a “capital runway” to expand its portfolio and business.

“The roadmap is not 100% set at this point,” he said. “We strive to take advantage of every opportunity in the best possible way.”

EchoStar’s stock has soared 377% this year, including a 49% rise since the beginning of December, giving the company a market capitalization of more than $31 billion. Earlier this month, the company received a buy-to-hold upgrade from Morgan Stanley, citing the value of recent spectrum deals.

The biggest beneficiary of the stock boom is Mr. Ergen, 72, who owns more than 143 million shares of the company, mostly Class B shares. His net worth increased by $12.2 billion this year to $16.6 billion, according to Bloomberg.

via sat

A view of the Viasat office at its headquarters in Carlsbad, California, on March 9, 2022.

Mike Blake | Reuters

via sat The stock price rose 315% in 2025 as the company expanded its business and won more contracts.

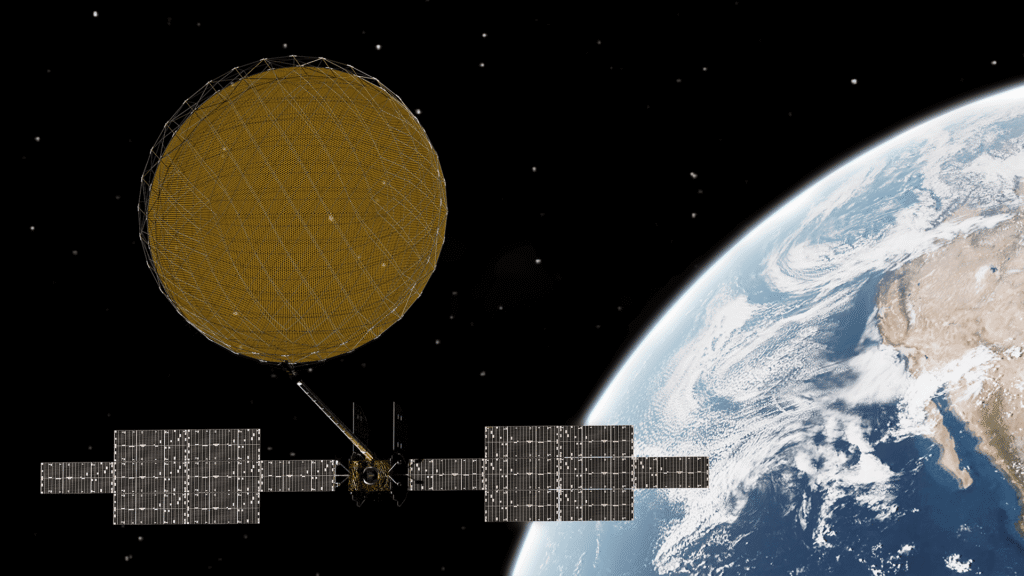

One of ViaSat’s most significant accomplishments was the successful launch in November of the ViaSAT-3 satellite, the second of three that will enter service in the Americas next year.

The company also has major government contracts, including a satellite contract with the U.S. Space Force, with the first launch scheduled for 2028.

On the commercial side, Viasat has expanded its partnerships with commercial airlines such as Etihad Airways, Aeromexico and Riyadh Airways. The company competes directly with SpaceX’s Starlink service. united airlinesAir France and Qatar Airways.

ViaSat attracted the attention of activist investor Carronade Capital this year, which upgraded ViaSat to an acquisition status last month. JP Morgan Chasehighlighted the potential separation of commercial and government operations.

Ondus

OndusThe company, which develops autonomous drone technology, has soared 251% this year.

The Boston-based company says on its website that it has 21 patents and is addressing a potential market of $130 billion.

Third-quarter revenue rose more than six times to $10.1 million, and the company raised its full-year revenue guidance from $25 million to $36 million. CEO Eric Block cited “a strong demand cycle for our unmanned platform” as a driver of growth.

Ondus has secured major contracts this year for Optimus drone systems, including a $14.3 million purchase order from a major defense contractor and a more than $3 million contract with the United Arab Emirates. The system allows governments, public safety agencies, and emergency services to autonomously collect data in harsh environments.

Backlog increased to $22.2 million in the latest quarter due to demand for Optimus and Iron Drone products.

Stifel initiated coverage earlier this month with a buy rating on Ondas, calling the company a potential leader in the unmanned systems space.

astronomy

Aerospace and defense system manufacturer astronomy This year, it’s up 241%.

The company provides charging and lighting solutions used by major commercial aircraft manufacturers, airlines, and others. boeing and delta. The company’s products are also supported by the US military and NASA.

Astronics announced that its backlog at the end of the third quarter totaled $646.7 million, of which the aerospace segment accounted for $572.5 million. This represents a slight decrease from the record backlog in the first quarter.

In October, Astronics announced plans to acquire Germany-based Buehler Motor Aviation. The deal is expected to increase revenue by $22 million next year. A month earlier, Astronics announced plans to sell $210 million in convertible debt.

WATCH: SpaceX could become the first $500 billion IPO