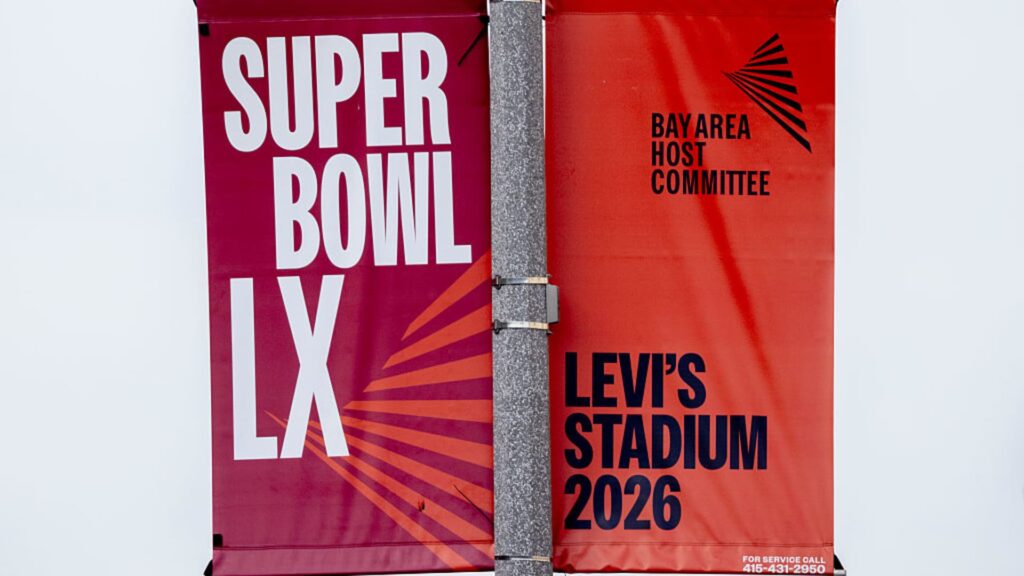

A Super Bowl LX sign is seen at the Civic Center Plaza in San Francisco on Friday, January 30, 2026.

Stephen Lamb | San Francisco Chronicle | Hearst Newspapers | Getty Images

The Super Bowl is the premier venue each year for advertisers looking to get their brands in front of millions of consumers at once. It also costs money.

That’s why some of the ad space reserved for streaming-only commercials is getting attention, giving smaller brands time on TV’s biggest night of the year.

comcast’s This year, the NBC broadcast network will broadcast Super Bowl 60, featuring the Seattle Seahawks and New England Patriots at Levi’s Stadium in Santa Clara, California. NBC’s streaming service Peacock will simulcast the event. Although streaming has become by far the most popular way to consume content, the Super Bowl is still primarily viewed via broadcast networks.

Streaming simulcasts are gaining viewers every year, and they have specific advertising spots dedicated to them.

Streaming-only spots will account for about 10% of all ad inventory during the Super Bowl and cost about half the cost of traditional TV commercials, said Mark Marshall, NBC’s chairman of global advertising and partnerships.

“It’s gotten a lot cheaper, but it’s still not cheap,” Marshall said. “And there’s also the fact that there aren’t that many spots like that, right? So I think people have realized this trick in the last few years, and it’s done really well on streaming. And as a result, a lot of people are lining up and wanting to do it.”

National advertising spending for the Super Bowl breaks records every year. NBC sold out of its Super Bowl ad inventory, with five to 10 ads selling for more than $10 million each, with an average of $8 million per 30-second commercial, CNBC previously reported.

Streaming-only ads still appear nationally, filling slots where regional commercials would air during traditional TV broadcasts.

These spots are attracting new advertisers outside of the mainstays like Budweiser and Ray’s. All of this year’s Peacock-exclusive commercials are new advertisers for NBC’s Super Bowl contenders, Marshall said. For example, cowboy boot brand Tecovas and family location safety app Life360 both purchased streaming-specific ad inventory this year.

The chief marketing officers of both brands pointed to the impact of the Super Bowl and the significant costs when explaining their decision to go all-in on Peacock.

Tecovas CMO Krista Dalton said in an email that the company’s streaming debut was an “intentional choice” that allows brands to capture the impact of the Super Bowl in a “very engaged environment while remaining disciplined with their investments.”

“Streaming is a great way to test what integrating into such a monumental cultural moment can do for our brand and business,” Life360 CMO Mike Zeman said in an email. “It allows us to reach an engaged audience of today’s connected families with an ‘out-of-pocket’ investment that doesn’t break the bank or take too much of a portion of your overall marketing budget.”

About 128 million viewers watched the Super Bowl last year on television or streaming, according to Nielsen.

NBC has offered digital services for the past four Super Bowl telecasts, but Marshall said more advertisers are vying for streaming space as the platform reaches 44 million subscribers.

And, fittingly, that growth has been largely driven by NBC’s live sports efforts. This month, NBC will broadcast the NBA All-Star Game, as well as the Super Bowl and the Winter Olympics, which begin Friday. This is a live sports program that the company is promoting as “Legendary February.”

“This is obviously a big year for NBC, and Peacock is selling out more than usual. We’re seeing a lot of brands lean toward Peacock,” said Doug Palladino of advertising agency PMG.

Palladino noted that the brand’s advertising during Sunday Night Football games, which are simulcast on Peacock, has seen positive results, especially because of streaming’s audience targeting capabilities.

Streaming-only commercials can also serve as a gateway for fast-growing brands looking to break into the big game.

Last year, direct-to-consumer health startup Ro bought its first ad during the Super Bowl. fox’s Streaming service Tubi.

“The results they got from the Super Bowl for the price they paid were orders of magnitude better than traditional spots,” said Philip Ingelbrecht, co-founder and CEO of ad tech company Tatari. Tatari worked with the brand to run streaming-only and traditional TV ads during both the 2025 and 2026 Super Bowl seasons, including Ro.

This year, Ro, which provides access to GLP-1 therapeutics and telemedicine appointments, ramped up its Super Bowl efforts, winning a traditional game coverage slot on NBC. Tennis superstar Serena Williams will anchor the ad.

“Last year, we stepped into Super Bowl advertising through our acquisition of Tubi, and it was a very attractive opportunity for us to really understand how our brand and creative worked in that environment,” said Will Flaherty, Ro’s senior vice president of growth.

Smaller brands also have more affordable options to test the waters.

Men’s grooming company Manscaped has decided to purchase a spot before kickoff to drive the next chapter of its business. It’s a less coveted time than during a game, but it’s still expensive.

Manscaped Super Bowl LX Campaign.

Provided by: Manscaped

Chief Marketing Officer Marcelo Kertesz said, “Manscaped is a brand that has been around for several years, but we are now at a very important moment in our trajectory, a big push into products that go beyond the crotch, and that is our first claim to fame.” “We have something new that we want to tell the world.”

“We know that the spot itself is just one part of it, a very important and very expensive part, but it makes sense to do it at this moment,” Kertesz said. “I think there is a desire for all brands to be on that stage at some point.”

Disclosure: CNBC’s parent company, Versant, broadcasts Olympic coverage produced by NBC Sports on its networks, including USA Network and CNBC.