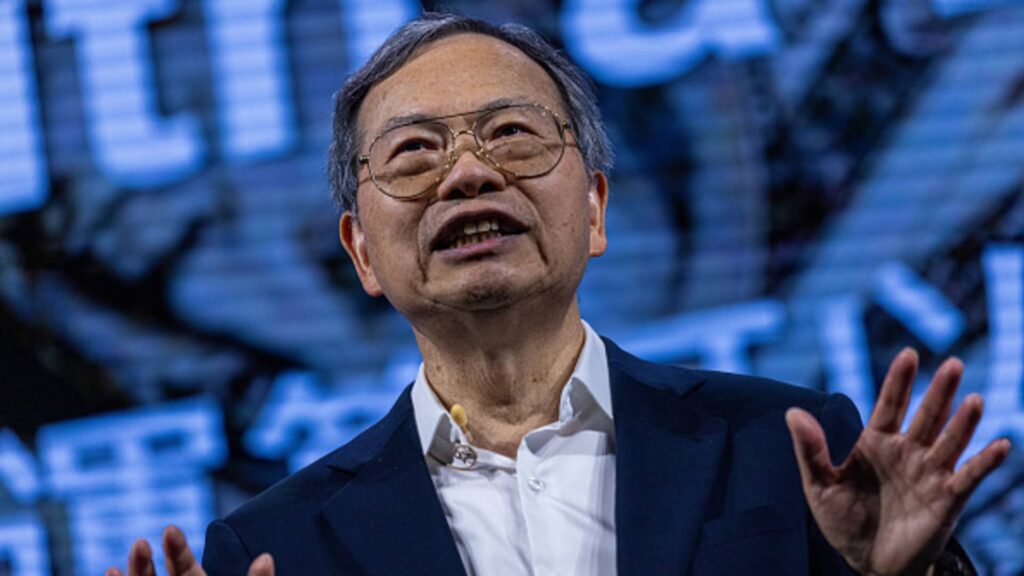

Charles Liang, CEO of Super Micro Computer Inc., during the Computex conference in Taipei, Taiwan, June 5, 2024.

Annabelle Chee | Bloomberg | Getty Images

super microcomputer Shares fell as much as 10% in after-hours trading Tuesday after the server maker reported lower-than-expected first-quarter results.

The company’s performance compared to analyst forecasts compiled by LSEG is as follows.

Earnings per share: 35 cents adjusted, 40 cents expected; Revenue: $5.02 billion, $6 billion expected.

Supermicro said in a statement that sales were down 15% from $5.94 billion in the same period last year. The report comes about two weeks after Supermicro released its preliminary results, which said sales for the quarter were expected to be $5 billion, down from previous estimates of $6 billion to $7 billion.

Net income fell more than half to $168.3 million, or 26 cents per share, from $424.3 million, or 67 cents per share, in the year-ago period.

Supermicro said in a partial report last month that “Designwin upgrades” pushed some of its first-quarter expected revenue into the second quarter. The company expects sales of $10 billion to $11 billion for the current quarter, beating the average estimate of $7.83 billion, LSEG said.

Super Micro has been a big beneficiary of the artificial intelligence boom because its servers are equipped with American graphics processing units. Nvidia. But after a spike in growth from late 2023 to last year, business has been flat, some analysts say. Dell gained market share.

Before Tuesday’s report, the stock had risen 55% since the beginning of the year.

Attention: Starving AI is a bad idea