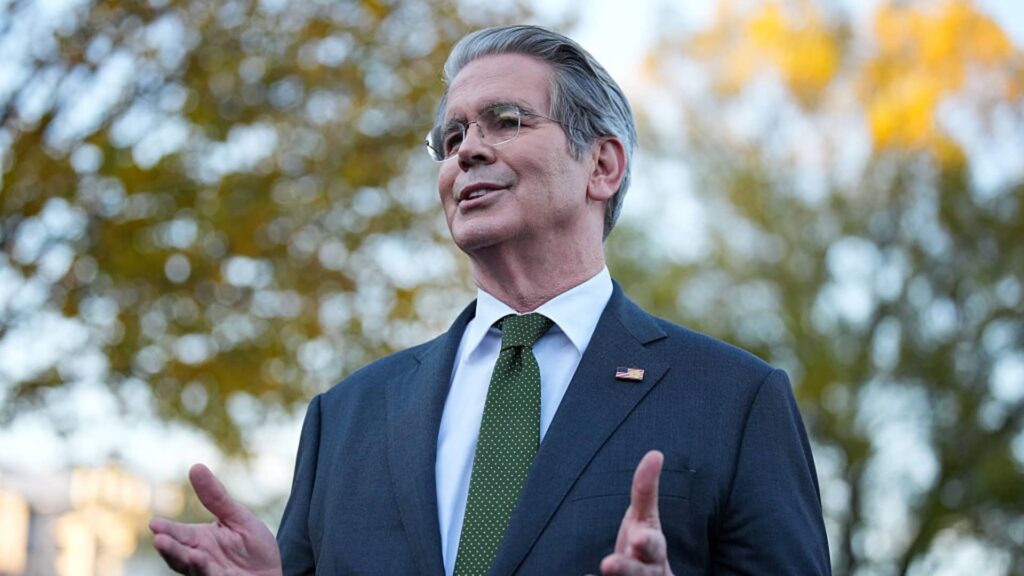

U.S. Treasury Secretary Scott Bessent arrives to speak at the groundbreaking ceremony for the Boeing South Carolina (BSC) manufacturing facility expansion in North Charleston, South Carolina, Friday, November 7, 2025.

Sean Rayford | Bloomberg | Getty Images

Treasury Secretary Scott Bessent said Sunday that the United States is at no risk of slipping into a recession in 2026, insisting that Americans will soon benefit from the Trump administration’s economic policies on trade and taxes.

“I’m very optimistic about 2026,” Bessent said in an interview on NBC News’ “Meet the Press.” “We are poised for a very strong non-inflationary growth economy.”

Bessent said some of the Republicans’ big spending plans, the “Big Beautiful Bill Act,” are still being implemented and have not yet been reflected in the economy. The new law makes permanent the Trump administration’s 2017 tax cuts, along with expanded state and local tax credits and advanced “bonuses” to offset Social Security taxes. The plan also includes tax breaks on tip income, overtime pay and car loans.

Healthcare costs are also expected to become more affordable, Bessent added. He said the Trump administration will release further news on the matter this week.

For now, health care costs are expected to rise for millions of people due to gridlock in Congress related to the extension of the Affordable Care Act Market Subsidy Expansion.

Bessent acknowledged that some parts of the economy, such as housing and interest rate-sensitive sectors, are showing signs of struggle. He cited the service economy as a contributing factor to inflation and argued that lower energy prices would soon lead to lower prices.

Kevin Hassett, chairman of the White House National Economic Council, also said on Sunday that economic data could show weakness in the fourth quarter due to the government shutdown. The 43-day standoff in Congress in Washington, D.C., was the longest in U.S. history.

A recent NBC News poll found that about two-thirds of registered voters say the Trump administration is not doing enough on the economy and the cost of living.

Americans’ views on the economy depend primarily on their income level, according to JPMorgan’s latest cost of living survey.

According to the bank, high-income respondents rated their confidence on average at 6.2 out of 10 (10 being the best). More than half of this cohort selected a rating of 7-10. In contrast, low-income consumers reported an average score of 4.4.