Although global growth forecasts for 2026 are relatively optimistic, the state of the global freight market provides reason for caution, with analysis of supply chain data showing that actual goods traffic does not reliably support the rosy outlook. President Donald Trump’s global trade war continues to have a ripple effect across the cargo market and is one reason for the data discrepancy, said Alan Murphy, CEO and founder of Sea Intelligence.

His analysis of the International Monetary Fund’s latest World Economic Outlook report finds a “stable” global economy and global GDP growth of 3.3% in 2026 and 3.2% in 2027, a picture of stability he says “masks that global trade growth is expected to slow significantly.”

“This decline appears to be a direct result of the ‘front-loading’ phenomenon seen throughout 2025, as shippers accelerated imports to get ahead of anticipated trade policy changes,” according to a new SeaIntelligence analysis. As a result, SeaIntelligence predicts that cargo markets and freight rates will remain under pressure as increased cargo volumes struggle to absorb new vessel capacity. ”

Murphy warned that the IMF’s trade outlook was skewed because it was based on higher-value technology exports.

“The IMF’s trade forecasts are based on dollar amounts, not TEUs,” Murphy said. “This creates a difficult scenario for container shipping stakeholders. The notable growth is largely value-driven by the technology sector, obscuring the reality of reduced physical demand for volume-dense goods,” he said.

He called the situation an economic “mirage” regarding shipping companies’ actual cargo volumes, which he expects to decline in 2026. Shipping companies, trucking companies, railroads and warehouses all make money by the amount of cargo they move and store.

Fewer ships will be needed, with no cargo surge on the horizon and more shipping carriers starting to return to the Red Sea after years of Houthi rebel attacks have made passage through the waterway too dangerous. The Red Sea is a faster trade route from Asia to Europe, eliminating the need for ships that once added to the long trade route around the Horn of Africa. This overcapacity has been cited as one of the reasons behind AP Moller-Maersk’s recently announced 1,000 job cuts. The integrated logistics provider said average freight rates across all routes fell 23% in the fourth quarter due to overcapacity on ships. This drop in rates resulted in a profit loss of $153 million in the company’s main shipping business.

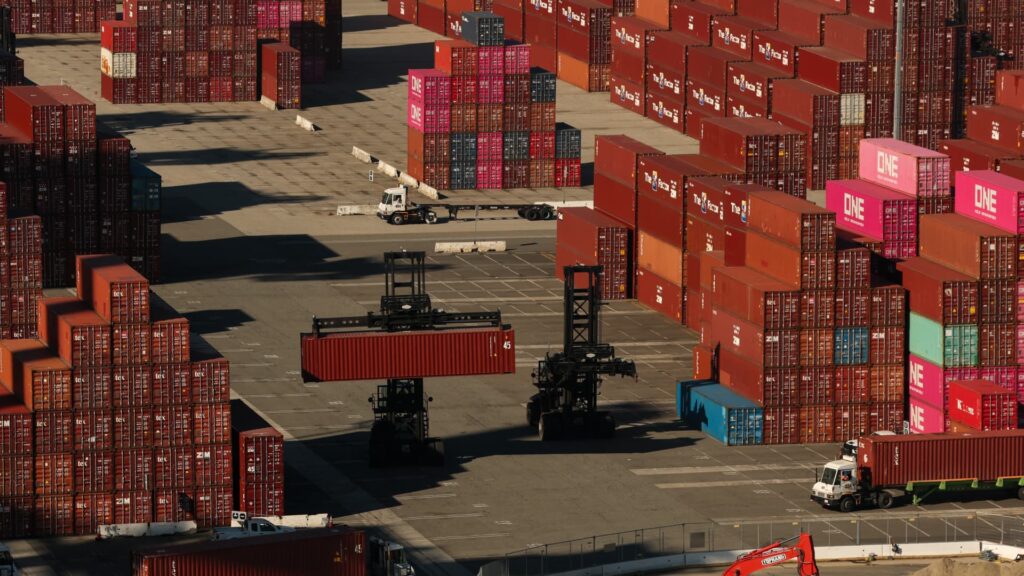

U.S. ports, including the Port of Long Beach, recorded record container volumes as a result of front-loading in 2025. The growth in port capacity was driven by trade from Southeast Asia.

“Just a few years ago, in 2019, China alone accounted for about 70% of our total inbound and outbound traffic,” said Noel Hasegaba, CEO of the Port of Long Beach. “Today, that proportion has fallen to 60%. We are seeing a 10 percentage point shift in trade to Southeast Asian countries such as Vietnam, Thailand, Cambodia and Malaysia.”

As tariff uncertainty continues this year, with President Trump announcing new deals in recent days with countries such as India, while also threatening more aggressive tariffs in other recent cases, and a Supreme Court ruling on Trump’s IEEPA tariffs likely to be handed down on February 20, the world of trade and supply chains will survive what some maritime experts are calling a “double squeeze.”

“This is a payback period for suppressed volumes after the 2025 front-loading, combined with the reality of changing trade policy to the point where the U.S. has a higher tariff cost base of about 18.5%,” Murphy said. He added: “In this environment, a ‘stable’ economy will not be able to provide the strong consumer demand needed to absorb these higher costs.”

US freight market is in expansion mode, but inflation is a concern

The US cargo market is currently expanding, but there are concerns about the impact of tariff inflation. Rising costs continue to impact the entire supply chain, according to January data from the Logistics Managers Index. Dale Rogers, a professor in Arizona State University’s School of Supply Chain Management and one of the LMI’s authors, said warehouse prices were roughly flat in January and December, reflecting a “drainage” of inventory heading into December.

The LMI score combines eight key metrics in the logistics supply chain, including warehousing, transportation, and inventory. Values above 50.0 indicate expanding logistics. A number below 50.0 indicates that the logistics industry is shrinking. The Logistics Manager Business Index for January was 59.6, up from 54.2 in December (+5.2), marking the fastest level of expansion since May last year. The year-over-year comparison to January 2025 was down (-2.4) from a reading of 62.0.

“The overall expansion rate was primarily due to a return to moderate inventory replenishment towards the start of the year,” Rogers said. “This suggests that respondents have maintained last year’s forward expectations and that inventories are relatively low at the start of this year. This likely reflects continued high costs,” he added.

Inventory costs rose to 71.3 (+8.4) in January, exceeding the 70.0 threshold for significant expansion. Inventory expansion is reflected in warehouse capacity dropping to the baseline of 50.0 (-11.2). The warehouse occupancy rate was 54.4, with a recovery from contraction to expansion (+11.6).

Transport prices are rising, and this supply chain indicator has expanded faster than ever since April 2022.

While Treasury Secretary Scott Bessent said on Capitol Hill this week that the tariffs are not inflation-inducing, Rogers said, “The fact that shipping prices and inventory prices are going up and warehouse prices aren’t really moving indicates that there’s probably some inflation that’s not being reflected in the consumer segment of the supply chain yet.”

“This raises an interesting question: Are the increases in transportation prices and inventory costs happening because the economy is improving, or is it inflation due to tariffs?” he said. “Inflation can mean an improvement in the economy, but these price increases must be at least partly due to tariffs,” he added.