Uber reported better-than-expected earnings in its fourth-quarter earnings report Wednesday.

Shares fell after the initial report, but rose 3% on a conference call with analysts in which the company touted its progress in self-driving cars.

The company’s results and LSEG consensus estimates for the period ended December are as follows:

Earnings per share: Adjusted 71 cents Revenue: $14.37 billion versus estimated $14.32 billion

Uber said in its earnings call that revenue was up from $12 billion in the same period last year. Revenue from its ride-hailing platform, Mobility, rose 19% year over year to $8.2 billion, while delivery revenue rose 30% to $4.9 billion.

Analysts had expected mobility revenue of $8.3 billion and delivery revenue of $4.72 billion, according to Street Accounts.

Net income for the quarter was $296 million, which included $1.6 billion of “pre-tax net headwinds from the revaluation of equity investments,” the company said. Net income for the same period last year was $6.88 billion.

Uber reported gross bookings of $54.1 billion in the quarter, beating analysts’ average estimate of $53.1 billion, according to StreetAccount. Gross bookings in the first quarter are expected to increase by at least 17% from a year ago to $52 billion to $53.5 billion.

The company’s biggest revenue growth in the quarter came from its delivery business, which started with restaurants and now includes grocery and retail stores. Partnership with OpenTable, ShopifyStore brands such as Loblaws in Canada, Biedronka in Poland, Seiyu in Japan and Coles in Australia drove the expansion.

Uber daily stock price chart

Uber’s delivery growth last year was the highest in Europe, the Middle East and Africa, CEO Dara Khosrowshahi said in prepared remarks ahead of the company’s earnings call.

Uber’s report comes at a time of transition for the ride-hailing industry, where self-driving cars are becoming more common, especially in urban markets.

Khosrowshahi reiterated the views he shared a year ago, saying he was further convinced that “AVs open up a multitrillion-dollar opportunity,” adding that “autonomy fundamentally amplifies the strengths of our existing platforms.”

In Atlanta and Austin, Texas, where Uber offered self-driving in 2025, overall trip growth “significantly accelerated” even with human drivers, the company said in a shareholder document. In San Francisco, where Uber doesn’t yet have a robotaxi option, “the addition of AV supply to the market has led to growth in the overall category,” Khosrowshahi said.

of the alphabet Waymo has been operating a driverless ride-hailing service through its app in San Francisco since 2024. In some markets, Waymo offers robotaxi rides exclusively through the Uber app.

An Uber Eats bag on Thursday, January 15, 2026, in Brooklyn, New York City, USA.

Michael Nagle | Bloomberg | Getty Images

Khosrowshahi said Uber plans to power AV travel in up to 15 cities around the world, split between the U.S. and other countries, by the end of 2026. “And by 2029, we intend to become the world’s largest AV travel intermediary,” he added.

Upcoming cities include Houston, Los Angeles, and San Francisco, as well as London, Munich, Hong Kong, Zurich, and Madrid.

But Khosrowshahi cautioned that given the technical, regulatory and other hurdles to widespread adoption of self-driving cars, “self-driving cars are likely to remain a small part of ride-sharing for many years to come.”

Uber is also focused on growing its Uber One program, and members tend to book more rides and buy more products through Uber after joining. The company is also investing in advertising.

Given the growing popularity of generative artificial intelligence, Uber said it is working to “expand discovery and attract new customers” through the integration with ChatGPT, allowing users to “discover services and restaurants” before completing checkout.

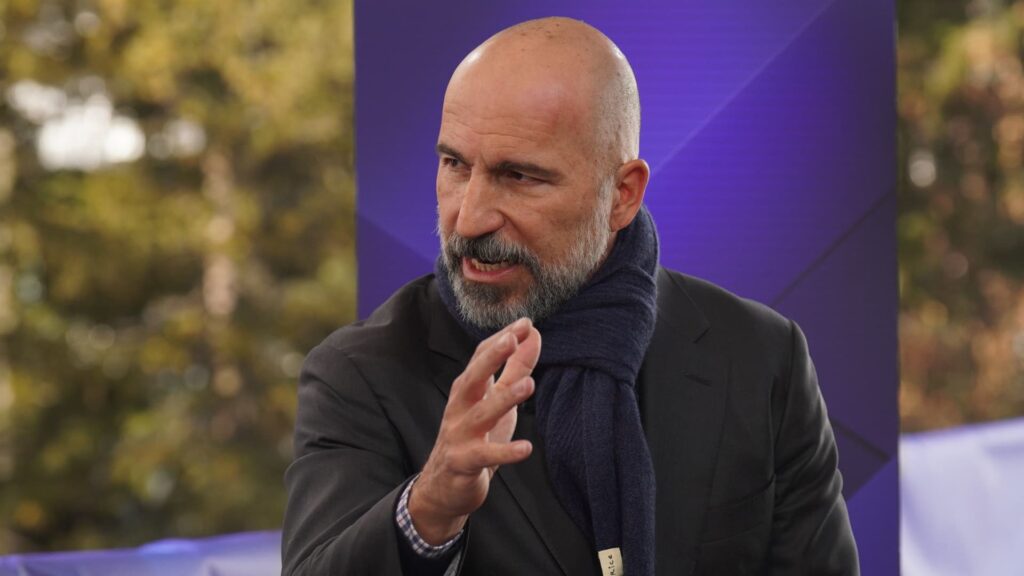

Featured: Uber CEO talks about consumer market