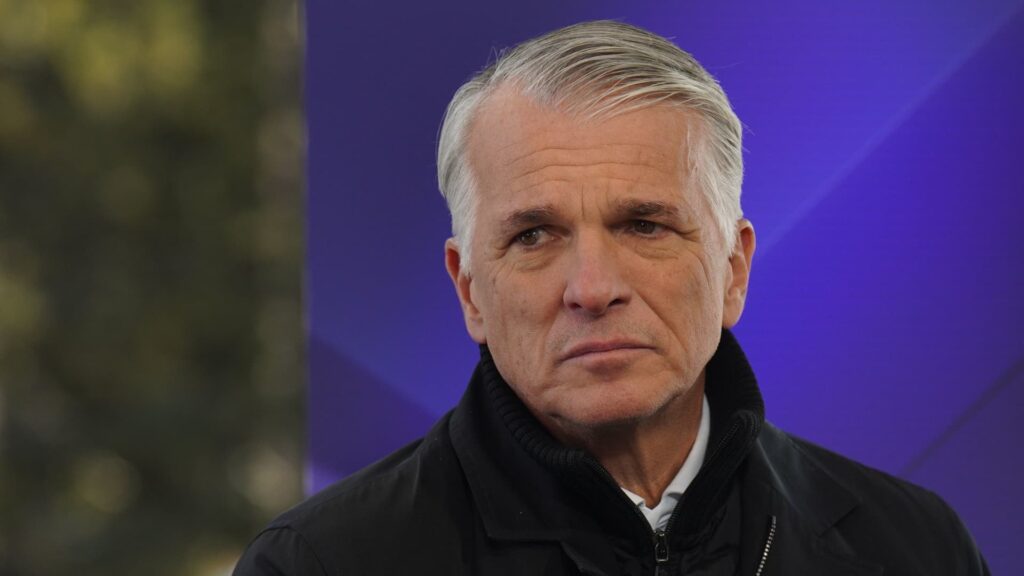

UBS CEO Sergio Ermotti speaks on CNBC’s Squawk Box at the World Economic Forum in Davos, Switzerland on January 20, 2026.

Oscar Molina CNBC

UBS Fourth-quarter profit rose 56% from a year earlier to $1.2 billion, exceeding expectations. The Swiss bank also announced Wednesday a $3 billion share buyback plan in 2026, but said it aims to exceed that target.

Danish pharmaceutical giant novo nordiskBut on Tuesday, the company disappointed investors by forecasting lower sales and profit growth this year. Following the surprise announcement (Novo was scheduled to report earnings on Wednesday), shares of Novo’s American Depositary Receipts fell more than 14%.

“In 2026, Novo Nordisk will face pricing headwinds in an increasingly competitive market,” CEO Mike Doesder said.

However, he expects tailwinds to prevail in the long term. Novo recently launched Wigoby in pill form, and a higher dose of the original injectable was approved by UK regulators. Dusdahl added that the company is always looking at potential M&A opportunities.

Major US indexes also had a bad day. On Tuesday, S&P500 lost 0.84%, Dow Jones Industrial Average Despite rising as much as 0.5% to a new record early in the session, the stock ended 0.34% lower.

High-tech oriented Nasdaq Composite This weighed on software stocks such as , which fell 1.43%. ServiceNow and sales forceboth are down nearly 7%, and investors appear to be pricing in the potential for artificial intelligence to reduce the value of these companies. Asian software companies fell as well on Wednesday, with Japanese names leading the region’s losses.

An asset company that holds a large amount of stock in the private credit market. blue owl, ares management and KKRwhich also sank on the U.S. side on Tuesday. According to alternative investment firm iCapital, the software industry accounts for about 20% of private loans from direct financial institutions.

There was at least one positive development overnight. President Donald Trump signed a bill that provides funding to the federal government, which has been briefly shut down since Saturday morning.

—CNBC’s Hugh Leask and Elsa Ohlen contributed to this report.

What you need to know today

Nvidia CEO Jensen Huang told CNBC’s Jim Cramer on Tuesday that the company denied rumors of a feud with OpenAI, saying there was “no drama involved.” Over the weekend, the Wall Street Journal reported that NVIDIA’s $100 billion investment deal in OpenAI was “on ice.”

The xAI and SpaceX merger is the largest in history, with the combined company valued at $1.25 trillion. That’s only 26% below Tesla’s current market cap, meaning Elon Musk currently derives more of his net worth from SpaceX than from Tesla.

Stephen Milan is stepping down from his White House job as chairman of the Council of Economic Advisers, CNBC has confirmed. He has been absent from this position since becoming a member of the Federal Reserve Board in September 2025.

Major indexes fell on Tuesday, with U.S. software and asset management stocks lower. Markets in Asia-Pacific bucked this trend and were mostly higher on Wednesday, even though software stocks in the region also fell. spot gold The price continued to rise and broke through the $5,000 level.

(PRO) JPMorgan added industrial property owners to its February favorites list, but removed some retailers. Wall Street Bank’s analyst focus list focuses on growth, income, value, and short investment strategies.