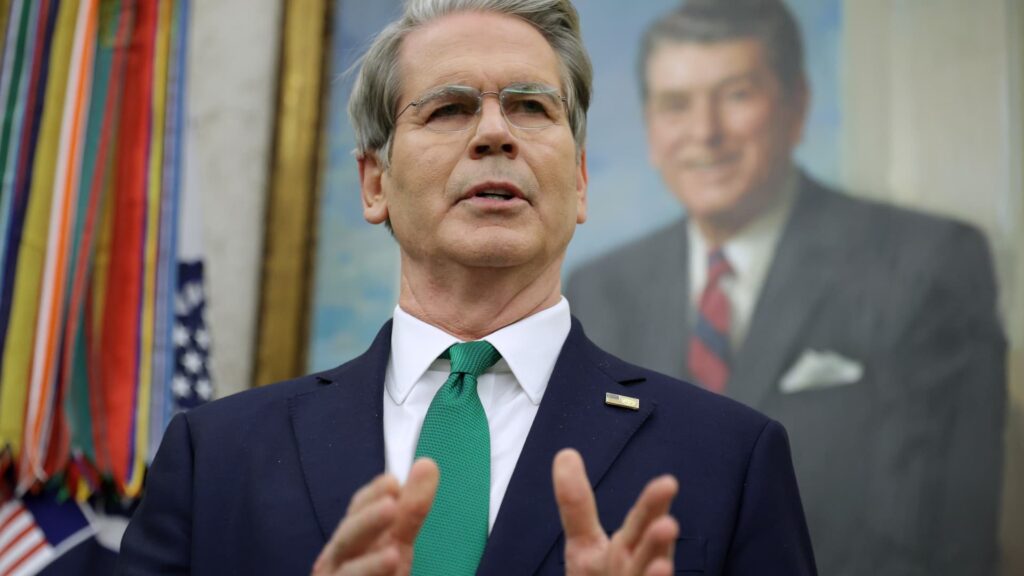

U.S. Treasury Secretary Scott Bessent speaks in the Oval Office of the White House where President Donald Trump signs an executive order on December 11, 2025 in Washington, DC.

Alex Wong | Getty Images

U.S. Treasury Secretary Scott Bessent told Reuters that additional U.S. sanctions on Venezuela to boost oil sales could be lifted as early as next week, and that he would also meet with the presidents of the International Monetary Fund and World Bank next week about re-engaging with Venezuela.

Bessent said in an interview late Friday that Venezuela could use about $5 billion worth of currently frozen IMF Special Drawing Rights financial assets to help rebuild the country’s economy.

“We are decertifying the oil that will be sold,” Bessent said during a visit to Winnebago Industries’ engineering facility. The Treasury Department was considering changes that would make it easier to repatriate proceeds from the sale of oil, mainly stored on ships, to Venezuela.

“How do we bring it back to Venezuela, run the government, run the security services and get it to the Venezuelan people?” he said of the Treasury Department’s sanctions analysis.

Asked when further sanctions on Venezuela would be lifted, Bessent said: “It could be as early as next week,” but did not specify which sanctions would be lifted.

The move is part of the Trump administration’s efforts to stabilize Venezuela and encourage the return of U.S. oil producers to the country, a week after U.S. forces detained Venezuelan leader Nicolás Maduro in Caracas and took him to New York on drug trafficking charges.

U.S. sanctions prohibit international banks and other creditors from engaging with the Venezuelan government without a license. Financial institutions say this is an obstacle to a complex $150 billion debt restructuring widely seen as the key to returning private capital to Venezuela.

On Friday night, President Donald Trump signed an executive order blocking courts and creditors from seizing Venezuelan oil revenues held in U.S. Treasury accounts, declaring that these funds must be protected in order for Venezuela to create “peace, prosperity and stability.”

IMF, World Bank re-engagement

Bessent, who controls overwhelming U.S. stockholdings at the IMF and World Bank, said the two institutions were already in touch about Venezuela.

He said the U.S. Treasury is prepared to exchange Venezuela’s IMF special drawing rights held by the fund into dollars for use in rebuilding the country.

Venezuela currently holds about 3.59 billion SDRs (equivalent to about $4.9 billion at Friday’s exchange rate), which it currently cannot access. The SDR consists of the dollar, euro, yen, pound, and Chinese yuan.

Last year, the Treasury agreed to support a $20 billion swap line to Argentina, using some of the country’s SDR, to stabilize the peso and help Argentine President Javier Millei’s party win parliamentary elections.

An IMF spokesperson said the fund was closely monitoring developments in Venezuela and declined to comment on Bessent’s reference to next week’s meeting.

The IMF has not engaged with Venezuela for more than 20 years, and its last formal assessment of the Venezuelan economy was completed in 2004. Venezuela paid off its last World Bank loan in 2007, and Maduro’s predecessor, the late Hugo Chávez, declared that Venezuela “no longer needs to go to Washington” for financing.

A person familiar with the World Bank’s internal discussions on Venezuela said the development lender was in the early stages of exploring how it could help Venezuela, noting that the bank moved quickly to help Afghanistan and Syria after the regime change, and provided early aid to Gaza and Ukraine.

fast moving person

Bessent said he believes small, privately held companies will quickly return to Venezuela’s oil sector, despite reluctance from some oil majors, including: exxon mobil‘s past Venezuelan assets have been nationalized twice.

“I think it’s going to be a typical development where private companies move quickly and come in very quickly. They’re not talking about financing at all,” Bessent said.

“Chevron has been there for a long time and will continue to be there, so I believe their commitment will increase significantly.”

Bessent added that he believes there is a role for the U.S. Export-Import Bank in guaranteeing loans to Venezuela’s oil sector, similar to previous comments by U.S. Energy Secretary Chris Wright.