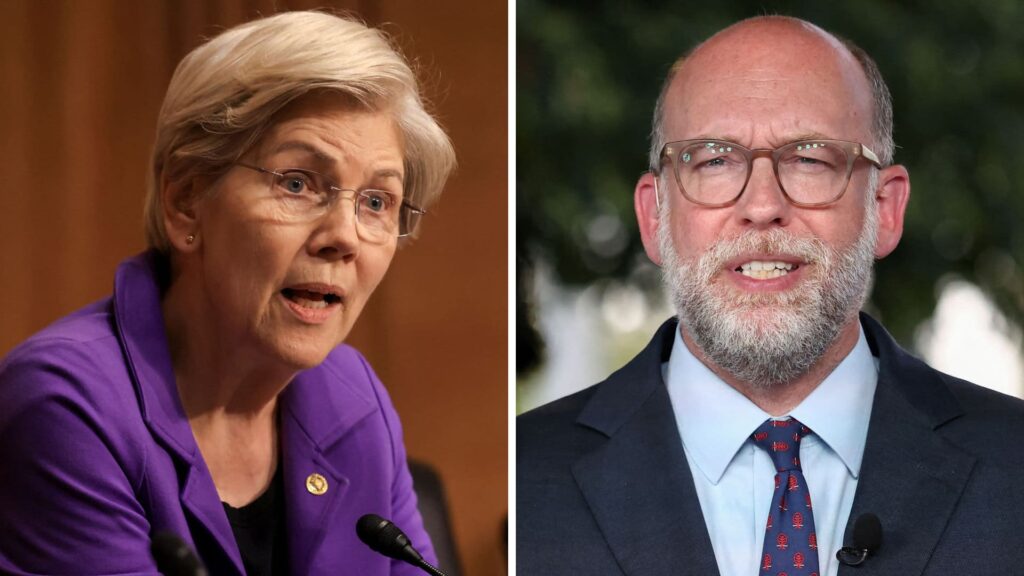

Sen. Elizabeth Warren (D-MA) and U.S. Office of Management and Budget Director Russell Vought.

Kevin Mohat Kevin Lamarque | |Reuters

Sen. Elizabeth Warren on Friday accused the acting director of the Consumer Financial Protection Bureau of undermining President Donald Trump’s stated push to make credit cards more affordable, according to a letter obtained exclusively by CNBC.

In a letter to CFPB Acting Director Russell Vought, Warren, Massachusetts, noted that the agency last year rolled back rules capping late fees on credit cards, sided with lenders in lawsuits over fraud, and suspended enforcement actions against the industry.

Earlier this month, President Trump called on U.S. banks to voluntarily limit credit card interest rates to 10% annually in a social media post. If they don’t, President Trump called on lawmakers this week to pass legislation on the issue.

“I spoke with President Trump last week and told him that Congress could pass a cap on credit card interest rates if President Trump fights for it,” Warren said in a letter to Vought.

“While Congress is considering legislation to address this issue, your own actions directly undermine the goals of the President,” she wrote. “Under your leadership, the CPFB has taken steps to make it easier, not harder, for big banks and credit card companies to defraud Americans.”

The letter from Warren seeks to capture Trump’s focus on affordability and capitalize on his initiative for his administration, amid heightened tensions over the financial regulator that Warren helped establish under Obama. Members of the Trump administration are seeking to shut down the CFPB as part of a broader pro-business deregulatory plan.

Current and former CFPB employees said the CFPB has been on life support under Mr. Vought, who has fought in court to enact mass layoffs and defund the CFPB.

An agency spokeswoman said the CFPB is not allowed to limit credit card interest rates under the Dodd-Frank Act.

Warren wrote that Vought should “utilize the full power of the (CFPB) agency to address excessive credit card costs and crack down on bad actors,” rather than trying to dismantle the CFPB.

Warren told Vought to “immediately reinstate the rule capping credit card late fees at $8, which will save Americans more than $10 billion a year.”

He argued that Vought should crack down on deceptive practices surrounding the industry’s deferred interest promotions, resume enforcing rules on monitoring interest rate increases, respond to mounting consumer complaints, and end bait-and-switch tactics with reward programs.

“Either President Trump is not serious about making credit cards more affordable, or you are unfairly ignoring his directives,” she wrote.